Four years ago, Jara Correo moved, in more ways than one. The city’s housing agency wanted her out of her Bronx apartment building so it could be fixed. It gave Correo a Section 8 voucher, to help her pay for a new apartment, which she found near Fordham Road. And with help from the U.S. Department of Housing and Urban Development and its Family Self Sufficiency Program, this former welfare recipient started saving money for the first time in her life.

Usually, when Section 8–subsidized tenants start making more money, they pay more toward their rent, too. That can discourage some from seeking higher pay and make it nearly impossible to save for the future. But as her income climbs, Correo’s rent stays the same. HUD calculates what her rent increase would be with her increased income and puts that amount into an escrow account administered by the local housing authority. A caseworker helps her set personal goals, including securing a job. After five years, Correo–and hundreds of other New Yorkers in similar situations–collects that money.

“I can’t really believe it,” Correo says. “I’ve been on welfare all my life. I’m working. It feels great. I’m making money–that feels great too.” With only one year to go, Correo wants to cobble together a down payment on a home. She’s expecting an estimated $12,000 back–perhaps not enough, but more savings than Correo has ever seen or expected. “I better get my money,” she says. “I’ve earned it.”

Correo may be earning something else, too: a ticket out of Section 8. Correo is making $18,000 a year right now, and she is the only wage-earner in her five-person household. But if her household income exceeds $33,900 next year, Correo will have to give up her Section 8 subsidy. Hundreds of other households have already left their rent aid behind because they now earn too much to qualify. According to Howard Marder, spokesperson for the New York City Housing Authority, of the more than 2,700 households his agency has enrolled in Family Self Sufficiency, 567 have made it through five years and cashed in. And 41 percent of those families, says Marder, “have moved on to better things”–they no longer rely on Section 8 to help them pay the rent.

Its focus on helping poor people earn more money has made Family Self Sufficiency, started in 1990 under President George Bush, a favorite across the political spectrum. Three years ago, the liberal Center for Budget and Policy Priorities called it “HUD’s best-kept secret for promoting employment and asset growth.”

But it’s the program’s capacity to move families off of rent subsidies that has captivated the second Bush administration. In its fiscal year 2005 budget, HUD says it will give financial rewards to local housing authorities that move families out of Section 8 entirely, and the agency encourages agencies to use incentive programs like Family Self Sufficiency to do it. It’s part of an overhaul that HUD will change rental assistance from an indefinite subsidy to a program that helps people make a transition to independence.

Currently, the federal government allocates money directly to public housing authorities based on the number of privately owned apartments they subsidize each year. In New York, that funding is perennially short. The city has a 10-year waiting list, with more than 125,000 families seeking Section 8 vouchers–more than the 105,000 presently receiving benefits.

Under the new Bush plan, the New York City Housing Authority would get its federal funding in a fixed block grant of cash, limiting available resources but creating flexibility that local officials have long demanded. Under the plan, HUD would no longer require 75 percent of vouchers to go to families living at less than a third of their area’s median income. It would also rescind a rule that limits tenants’ rent to 30 percent of their income. So if local authorities wanted to serve more families with smaller subsidies, or focus the support on higher-earning households, they could.

“We are not saying that every housing authority will change,” Michael Liu, assistant secretary at HUD, said, announcing the sweeping proposals. “We want to give them the opportunity to change if they want.”

In comments to WNYC radio in February, New York City Housing Authority Chief Operating Officer Douglas Apple suggested he was interested in taking advantage of that opportunity, and in using incentives to encourage households to make more money, give up their vouchers, and free up room for families on the waiting list. In order to “move up the income ladder,” he said, “we have to give people the benefit of additional income.”

It’s an ambitious goal. In the 14 years that New York City tenants have participated in Family Self Sufficiency, only about 5,000 families have enrolled in the program, the majority through the city Housing Authority.

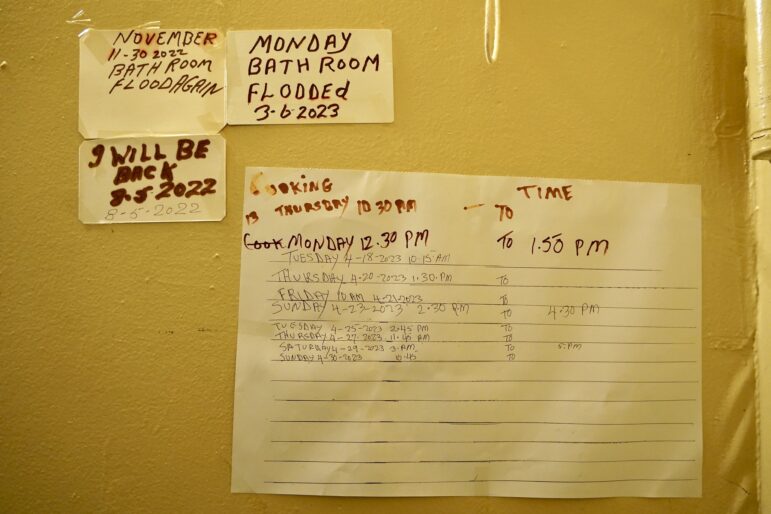

The city’s Department of Housing Preservation and Development also participates in Family Self Sufficiency, but just 73 of its tenants have completed it so far, out of 2,300 that enrolled. It’s only fairly recently, explains spokesperson Carol Abrams, that the agency has moved to steer large numbers of households into the program. Three years ago, HPD moved 750 households on welfare, including Jara Correo’s, out of abandoned buildings needing rehabilitation. Caseworkers signed up 741 of them for Family Self-Sufficiency.

But while the program provides powerful incentives to earn and save more money, moving out of Section 8 requires a fairly rapid increase in income. Many participants are simply not making that much, says Sandra Reyes, a caseworker with the organization WHEDCO who helped find jobs for HPD’s Family Self Sufficiency clients. Reyes’ clients found jobs paying $8 an hour and up working at Banana Republic, in schools as assistants, and as hotel housekeepers. “It takes a lot more than five years to become self-sufficient,” says Reyes.

The Housing Authority is more sanguine about participants’ prospects. The agency claims their average income was between $13,000 and $15,000 last year; for more highly skilled workers, between $20,000 and $23,000. Their increasing earning power shows up in their escrow accounts: last year, it ranged from $164 to $16,923. Marder says that many of the households now earning too much to receive Section 8 include more than one working adult.

While celebrating the program’s successes, even fans of Family Self Sufficiency are wary of the new proposal, because funding for Section 8 rental assistance overall is being cut dramatically. Observers estimate that the budget falls between $1.1 billion and $1.5 billion short of what will be needed just to keep the existing number of vouchers in circulation. The feds also want to eliminate $40 million in special federal funding for the kind of case management Reyes provides, leaving it up to local authorities to decide whether they want to spend precious block-grant cash on support services. “This is sophistry,” says Barbara Sard, director of housing policy at the Center on Budget and Policy Priorities. “This is the worst thing that can happen.”

Of the voucher cuts, Apple says they add up to an estimated loss of 5,000 vouchers in New York City. The National Low Income Housing Coalition estimates a loss of 250,000 vouchers nationwide. Public housing authorities have begin to publicly criticize the cuts.

The Bush administration’s stated objective: “reducing the number of families on long waiting lists throughout the country.” How it will accomplish that remains to be seen.

Additional reporting by Kai Wright.