In a swerve from precedent, the Rent Guidelines Board’s two tenant members dismissed Tuesday’s preliminary vote as a sham, casting a vote of no confidence in both the board and Mayor Eric Adams.

Adi Talwar

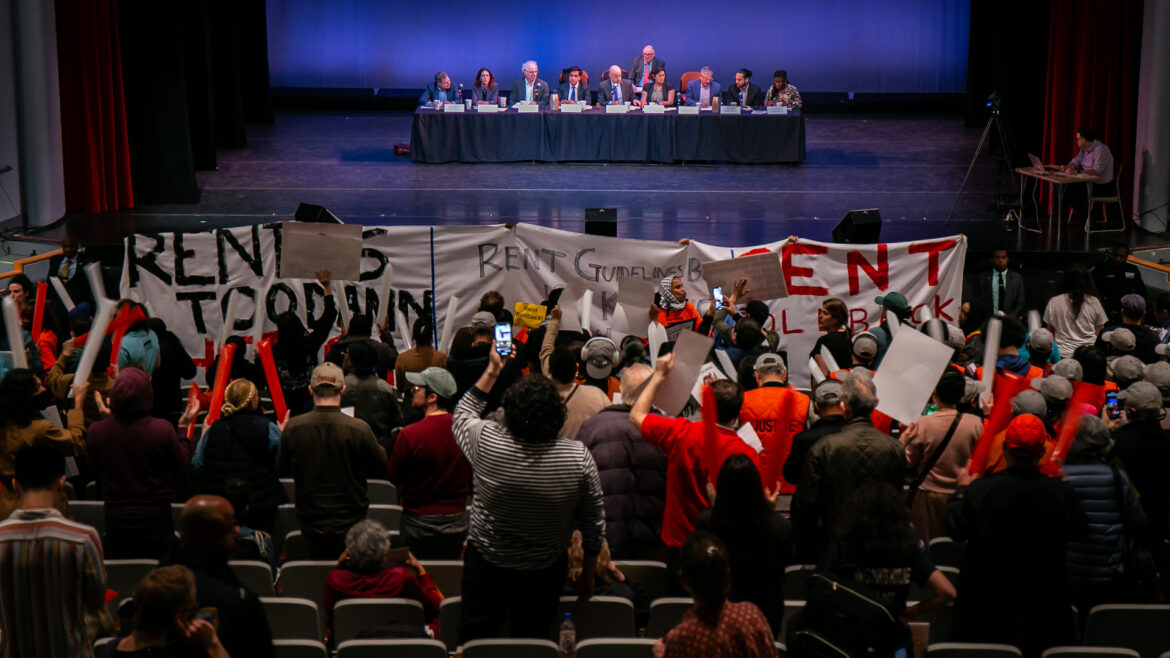

Tuesday night marked the Rent Guidelines Board’s annual preliminary vote, which has historically set the goalposts for rent adjustments for stabilized tenants.An already eventful year for tenants across New York City’s nearly 1 million rent stabilized apartments just got more raucous.

Tuesday night marked the Rent Guidelines Board’s annual preliminary vote, which has historically set the goalposts for rent adjustments for stabilized tenants, who also benefit from lease renewal rights. Renters and landlords alike will have chances to voice their concerns at public hearings in the coming weeks, ahead of a final vote on June 17.

Gathered at LaGuardia Performing Arts Center in Long Island City, Queens, seven of the board’s nine mayoral appointees voted 5-2 in favor of rent hikes between 2 and 4.5 percent for a one-year lease and 4 to 6.5 percent for two years. Minutes earlier, its two tenant members had walked out in protest, along with most of the chanting crowd.

Board members Adán Soltren, a tenant lawyer, and Genesis Aquino, executive director of the organization Tenants and Neighbors, dismissed the process as a sham, casting a vote of no confidence in both the board and Mayor Eric Adams.

“Framing the issue as one of degrees of suffering between… owners who have negative consequences from business decisions and tenant suffering is abhorrent,” Soltren said in lengthy remarks before leaving the stage. “They are not, nor will they ever be equal, and the practice of treating the two as though they are is morally indefensible.”

Above: Board members Adán Soltren, a tenant lawyer (left), and Genesis Aquino, executive director of the organization Tenants and Neighbors (right), walked out of the hearing in protest. Photos by Adi Talwar.

Preliminary ranges and final rent increases have been relatively consistent during Adams’ first term, harkening back to the Bloomberg era. Last year saw a 3 percent increase for one year leases signed starting Oct. 1 and an unusual split for two-year leases, equivalent to a 4.4 percent hike.

Jay Martin, executive director of the Community Housing Improvement Program (CHIP), a landlord trade group, stated Tuesday night that his members need a rent increase “near the highest part” of the range. He also bemoaned how the meeting played out, calling it an “appalling circus.”

During former Mayor Bill de Blasio’s tenure, the board instituted the only one-year rent freezes in its history, in 2015, 2016 and 2020. Unlike de Blasio, who was explicit in calling for freezes, Adams often urges consideration of small property owners. “Everyone is dismissive of them,” he charged at an April 2 press conference.

Following Tuesday’s vote, Adams stated that the board must strike a balance between protecting tenants and helping landlords maintain buildings, but that 6.5 percent is “far beyond what is reasonable to ask tenants to take on at this time.” His administration has defendended the board process as independent and data-driven.

This year’s expected rent increases come on the heels of a tense state budget season, resulting in new eviction defenses for New York City tenants who don’t live in stabilized apartments. But the Good Cause Eviction law has numerous carve outs, and comes with the most significant changes to rent stabilization law since 2019.

The deal at least doubled the Individual Apartment Improvement (IAI) cap, which limits how much stabilized landlords can increase rents to cover renovations. At a late April Rent Guidelines Board (RGB) meeting, real estate industry representatives dismissed these increases as insufficient to get empty apartments ready for market.

“Legislators who did their own renovations were joking, ‘Maybe that gets me a new bathroom and a new kitchen.’ Forget about making things lead-safe… [or] electrical code upgrades,” said Reggie Thomas, senior vice president of government affairs at the Real Estate Board of New York, which participated in budget negotiations.

Adi Talwar

Tenants rallying at the Rent Guidelines Board preliminary vote Tuesday night.But tenant advocates have urged the board to take these newly-allowed rent hikes into consideration. Esteban Girón, an organizer with the Crown Heights Tenant Union, told City Limits Tuesday that the prospect of larger IAIs for vacant apartments makes it “crucial” to maintain affordable rents for existing tenants.

Since late March, the RGB has also been reviewing a series of staff reports, aimed at assessing the economic conditions tenants and landlords are facing.

Some landlord metrics have improved recently. For example, one study calculates their net operating income, or NOI, which is revenue after operating expenses, albeit with a one-year lag. Citywide NOI for buildings with rent stabilized units increased 10.4 percent between 2021 and 2022, after falling nearly as much the year prior.

Landlord trade groups have dismissed the citywide NOI as misleading, noting that the biggest gains took place in Manhattan south of West 110th and East 96th streets, where NOI increased 42.3 percent following a temporary pandemic dip. In the Bronx, by contrast, NOI dropped 14 percent. Brooklyn and Queens saw modest gains.

Joseph Condon, general counsel at CHIP, recently urged the board not to be “distracted” by the rosy citywide figure. He drilled down further to NOI data for older buildings, which he argued are in more dire straits than new rent stabilized buildings, which benefit from tax breaks.

“If you peel out Core Manhattan, and you peel out all of the post-[19]73 regulated buildings, you’re looking at a citywide drop of around 16 percent,” he said at an April 25 board meeting.

But tenant advocates have argued that many real estate portfolios are geographically diverse, suggesting a cushion for landlords’ various pain points. Oksana Mironova, housing policy analyst at the Community Service Society of New York (a City Limits funder) recently cited analysis from the tenant-aligned nonprofit JustFix.

Adi Talwar

Tenant groups Marched through Queens on their way to the Rent Guidelines Board preliminary vote.According to JustFix, 54 percent of rent stabilized buildings in Core Manhattan share owners with rent stabilized buildings in other parts of the city. “Even though Manhattan may be an island, property ownership is not,” Mironova testified on April 25.

As for tenants’ economic conditions, the RGB found that average inflation-adjusted wages fell 6.1 percent from late 2022 to mid 2023. Residential evictions also increased nearly 200 percent in 2023, hitting 12,139—still lower than 2019, before the COVID-19 pandemic slowed housing court.

Rent stabilized households have a lower median income than their market rate counterparts, according to the latest Housing Vacancy Survey: $60,000 in 2022, compared to $90,800.

The survey also found that 20 percent of rent stabilized tenants are food insecure, or unable to afford either full or balanced meals at least part of the time, compared to 12 percent of market rate renters.

In a historically tight rental market, stabilized apartments are a precious resource, according to Lucy Block, senior research and data associate at the Association for Neighborhood and Housing Development (ANHD), a member group of nonprofit developers and tenant groups.

Her recent analysis found that over 700,000 New York City renters would need to find apartments renting for less than $1,100 to escape living with rent burden—a federal designation for spending more than 30 percent of one’s income on housing.

Yet there are only 2,300 such apartments available, according to the HVS. Just over a quarter of the city’s rent stabilized apartments are in this most sought-after rent category, according to Block.

“If the RGB votes to increase stabilized rents, we will lose even more of the city’s extremely limited low-rent housing stock,” she said in a written statement ahead of Tuesday’s vote.

Paying the rent is already a challenge for Viola Bibins, a 77-year-old rent stabilized tenant from Crown Heights who attended Tuesday’s vote. “I have to decide: should I pay for my medication or should I pay my rent?” she told City Limits. “I am on a fixed income because I’m retired, and my rent isn’t that high but I still can’t afford it.”

Adi Talwar

“I have to decide: should I pay for my medication or should I pay my rent?” said Viola Bibins, 77, a rent stabilized tenant from Crown Heights, Brooklyn.To the extent that there is distress across rent stabilized buildings, it would be neither fair nor effective to compensate landlords with rent increases, tenant advocates have argued. Particularly when renters may not be able to pay the difference.

In his board testimony this month, Jacob Udell, director of research and data at the University Neighborhood Housing Program, said these issues are better addressed with government subsidies like rental vouchers, and through regulatory interventions like the preservation plan set up following Signature Bank’s collapse last year.

The RGB has a hammer, he testified earlier this month. But that “does not mean that the host of problems in the rent stabilized market is a nail.”

To reach the reporter behind this story, contact Emma@citylimits.org. To reach the editor, contact Jeanmarie@citylimits.org

Want to republish this story? Find City Limits’ reprint policy here.

4 thoughts on “NYC Stabilized Tenants Face Another Round of Rent Hikes”

Let me correct that headline for you. “Struggling Small property owners face another year of sub-inflation revenue revenue adjustments”

Let me correct that headline for you. “Struggling Small property owners face another year of sub-inflation revenue adjustments”

People criticize deBlasio, but we had 3 rent freezes in 8 years, and Adams, a fake democrat who’s campaign was funded by $20 mil of real estate and financial industry money, gave us the 2 largest increases in a decade!!! That’s what voters get when they don’t do their research, and believe a one time republican, who’s also a landlord, had their back!!! None of the other democrats in the primary would have done this. The mayor has the most votes on the board yet pretends to sympathize with the struggle of lower income New Yorkers who use most of their income on rent. What a phoney!!! His appointees do what he wants!!! Expecting another 3-3.5% increase, third year in a row- followed by smaller increase in election year !!!!

One-year rent hike at closer to 3% and two-year rent hike at closer to 6% are almost the same as the rent increase of non-rent-stabilized housing market. How could RGB lose the sight of the reality of the NYC housing market? The word “stabilized” rent is meaningless, because the rents are literally continuing up and up, at the non-stabilized rates. How many members are among the RGB? They should experience the same financial pressure by the rent hike as the tenants of the rent-stabilized apartments have to suffer.