Gov. Kathy Hochul said Friday that the state had applied for a $996 million reallotment from the Treasury Department and that officials will shut down the Emergency Rental Assistance Program (ERAP) application portal Sunday.

Sadef Kully

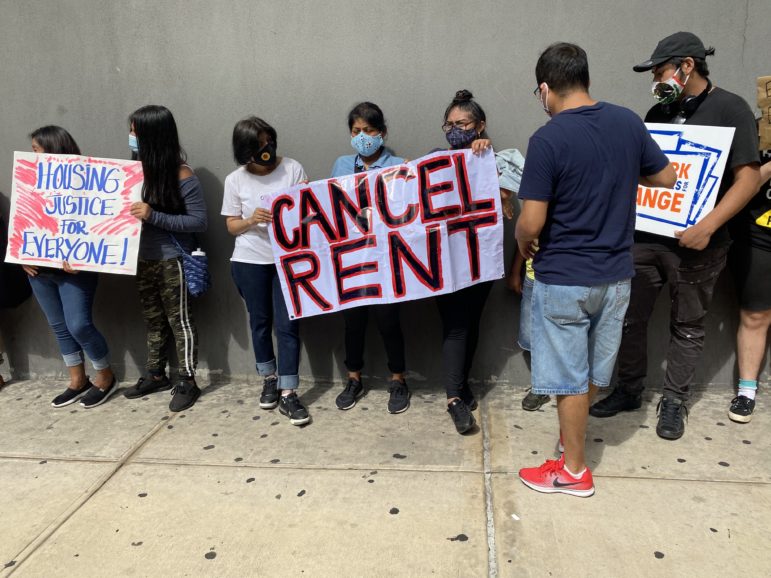

The scene from a June protest by Housing Justice for All.This story has been updated since its original publication.

Lea la versión en español aquí.

New York’s $2.4 billion rental assistance fund has nearly run dry, prompting state officials to scramble for a federal cash infusion to cover back rent for thousands of COVID-impacted tenants and landlords—including low-income New York City applicants currently locked out of the program.

Gov. Kathy Hochul said Friday that the state had applied for a $996 million reallotment from the Treasury Department to cover existing applications and that officials will shut down the Emergency Rental Assistance Program (ERAP) application portal to most new submissions Sunday.

The funding crunch comes at a precarious time for tenants and property owners, with eviction protections set to expire in just over two months. After a creaky start marked by delays, errors and inefficiencies, the ERAP program began to pick up steam in August, allocating hundreds of millions of dollars to New York landlords on behalf of low-income tenants who were unable to pay their rent as a result of the pandemic. Overall, nearly 280,000 households have submitted ERAP applications and the state has issued payments to 81,209 property owners since the portal opened June 1.

“While New York accelerated getting rent relief out the door and moved from the back of the pack to the front amongst other states, there are still many individuals in need of assistance,” Hochul said.

In the days before Hochul’s announcement, OTDA posted a warning on its website informing would-be applicants that ERAP funding was all but gone. The message encouraged applications only from renters and landlords in eight specific counties “where allocations have not yet been exhausted,” including Nassau, Suffolk and Westchester.

“While applications are still being accepted by OTDA, funding is not likely to be available except in the categories below,” the website states, above a list of the eligible counties. Renters making between 80 and 120 percent of Area Median Income (AMI)—$85,920 to $128,880 for a family of three in New York City—can also apply, the OTDA site states. State lawmakers enacted new eviction protections in September that also made funds available to higher-earning tenants struggling to make rent.

That leaves out low-income tenants, who have so far made up the vast majority of ERAP applicants. Statewide, about 69 percent of ERAP applicants reported earning less than 30 percent of AMI, or $32,200 for a family of three, according to OTDA reports. Another 20 percent earn between 30 and 50 percent of AMI—no more than $53,700 for a family of three in the city.

The five counties that make up New York City were not among those being encouraged to apply for funding, but that hasn’t slowed demand from renters in need, according to the nonprofit organizations tasked with assisting Big Apple applicants.

“The demand has not tapered off,” said Scott Auwarter, the assistant executive director of BronxWorks, which received a $5 million grant to help Bronx tenants apply for ERAP. “Our call center is as busy as ever. We are seeing an increase in the number of clients who have been denied ERAP assistance and are trying to figure out how best to handle the appeals process.”

He said he was not aware that the state was planning to suspend the portal. Another, new round of funding will be essential, he said, because many tenants won’t apply until they feel they are truly in danger of losing their apartment. In many cases, that won’t be for another two months, when state eviction protections expire on Jan. 15.

“The most effective notification to get some people to apply for this is an eviction notice,” he said. “I am very concerned that some of the most needy tenants have not yet applied and won’t until the eviction moratorium is lifted.”

The Community Housing Improvement Program (CHIP), an organization that represents 4,000 rent-stabilized property owners in New York City, shares that concern. CHIP conducted a survey of its members who own nearly 70,000 residential units and found that just over 44 percent of households in arrears had applied for ERAP relief.

CHIP said extrapolating that data across the full population of rent-stabilized apartments means 123,000 households are in rent arrears, but 54,304 had actually applied for ERAP. That leaves nearly 69,000 households with outstanding arrears that had not yet applied.

CHIP says the nearly $1 billion Hochul requested from the federal government will likely be enough to cover existing applicants, but will not be nearly enough to pay off arrears for tenants who have not yet applied.

New York’s Congressional delegation has sought to spur the federal government into action. Seventeen representatives from across New York sent a joint letter to Treasury Secretary Janet Yellon Friday supporting the state’s application and urging the feds to release the money. The Treasury Department posted a form for states to apply for additional relief on its website Oct. 25.

Senate Housing Committee Chair Brian Kavanagh said suspending new applications was a “catastrophically bad decision” because the submissions serve as a protection against eviction in Housing Court.

The state’s Office of Temporary and Disability Assistance (OTDA), which administers ERAP, did not respond to a question about whether tenants can send in applications after Sunday and use those submissions as a defense against eviction proceedings.

While the state awaits the additional money, Legal Aid Society Supervising Attorney Ellen Davidson said she worries the portal’s shutdown on Sunday will plunge a challenging process into chaos, as tenants and property owners attempt to continue applying for relief that isn’t there.

She said the early rollout of the ERAP portal doesn’t inspire much confidence.

“They did such a terrible job with launching this program and at this point, we finally hit a stride where people are finding out about this program and theoretically they would be applying,” Davidson said. “But the idea that they would close down the applications before they reapply for more money is ridiculous. It’s like they’re saying to tenants that they’re on their own and the state isn’t around to help them anymore.”

6 thoughts on “New York’s COVID Rent Relief Fund Is Almost Out of Money”

I really need the rental money that has been promised for almost 2 years

But the city, state and country has the funds to house, clothe and feed hundreds of thousands of Afghan “refugees” Biden has imported into the USA.

yea Kathy the tenants will feel like they’ve been left out like what you did to the landlords 20 months ago

Kathy how about some tax relief for the landlords providing all of these free homeless shelters with what was supposed to be their rental income properties

If the state of NY is going to allow the tenants to live for free and not be evicted, then the state of New York needs to give some relief to the many landlords that still have to pay city, county taxes for each income property with no income coming in.

I am almost broke and my County taxes are due in Feb and in April my School and City taxes are do !!!! Am I about to loose my income properties because I can not pay the mortgages or the taxes. Does the Governor care about the property owners ……GUESS NOT !!!

We need to form a group to sue the State of NY for holding us hostage from our own properties… I have a tenant that has been horrible for almost 4 years…since month 2 she has been late and or has an excuse why she can’t pay… Car repairs, had a baby and diapers are expensive! I have to text her weekly to get any money. when Covid hit.. she asked me how she could not pay her rent?.. now with the ERAP, she had 4 months of free rent and now is 3 1/2 months behind and has not paid a dime. she has applied for more assistance, I read that the fund is out of money but, they won’t give me any information if this will be approved and SHE has eviction protection! When and if they tell me she is NOT approved, I will have to give her 90 days notice to evict. So I will be out 6 Months RENT! Who is there to help me???

And they are threatening to sue me because I had the furnace serviced and the techs said that the furnace puffed some soot and the tenants would not let them clean up.

This State needs to hear these problems!