Government funding is scarcest just when it’s needed most. That cruel recession irony is prompting one advocacy group to launch a campaign that could add hundreds of millions to the pockets of low-income New Yorkers–without costing the city a penny.

More than half a billion dollars in tax refunds meant for poor working families go untouched each year because as many as 200,000 city taxpayers who are eligible for the Earned Income Tax Credit (EITC) rebate fail to fill out their tax forms properly, or do not file at all.

According to studies commissioned by the Internal Revenue Service, between 15 and 25 percent of taxpayers eligible for the federal- and state-funded rebate do not receive their payments. To qualify, a family must earn less than $32,121 a year, individuals less than $10,710. The lower the income, the higher the rebate: A family with two children that earns $12,000, for example, receives the largest credit, $4,008. On top of that, New York State offers its own tax credit totaling 25 percent of the federal refund.

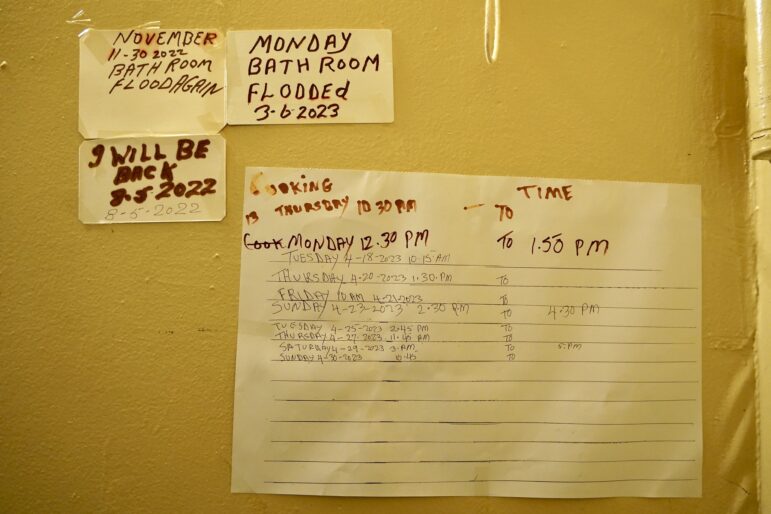

However, many workers, particularly non-English-speaking immigrants who fear deportation and former welfare recipients who are new to the job market, do not file their taxes at all.

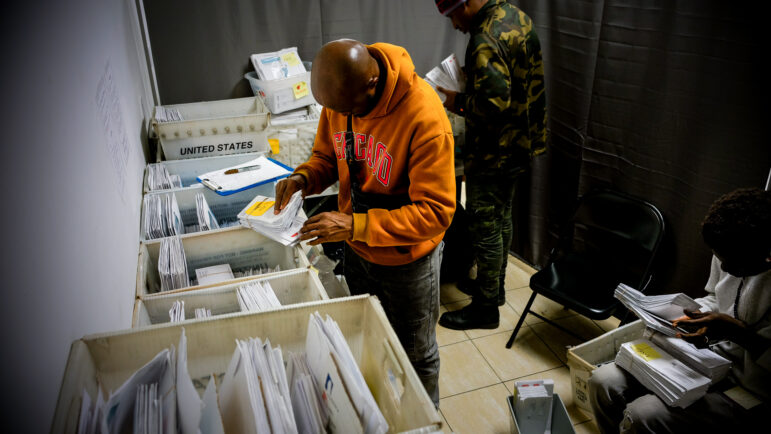

“We’re in such a financial crisis and there’s this big pile of money just sitting there,” says Amy Brown of the Community Food Resource Center. To get that money to the people who need it, CFRC is offering free tax preparation at seven locations including soup kitchens, credit unions, union halls and the offices of neighborhood groups. They’re also running radio ads and a toll-free information line in English (866-WAGE-PLUS) and in Spanish (866-DOLARES).

With a growing recession and tremendous job loss since the September 11 attacks, there’s no doubt those rebates would help. Says Russell Sykes, vice president with the Schuyler Center for Analysis and Advocacy, which helped write the state EITC bill: “That can single-handedly jump that family over the poverty level.”