Florina, 62, and her husband, who is 63, haven’t paid rent on their rent-regulated Bronx apartment in months.

The husband has not been able to work in 16 years and is blind. Florina does sporadic cleaning work to bring in extra income but is otherwise retired. Neither receives any kind of disability or Social Security benefit, due to their immigration status.

In January of 2019, Florina received a notice saying that her rent would go up by 30 percent, an amount the family couldn’t pay.

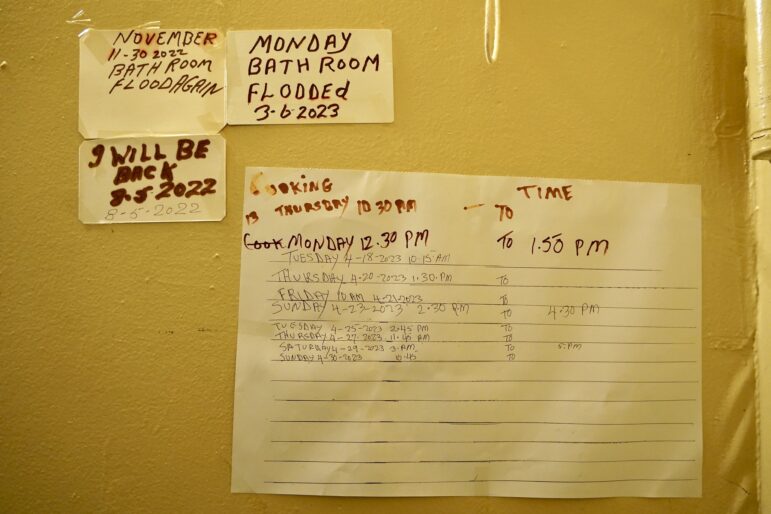

The couple are one of a few dozen residents of a building in the Bronx who are now on a rent strike. The couple, along with their children and grandchildren, with whom they live, are protesting a Major Capital Improvement – a rent hike on regulated units intended to fund building-wide repairs that they said raises their rent beyond what they can pay. The hike was approved prior to last summer’s rent reforms, which curtailed the practice. They are also protesting deteriorating conditions in their home.

In response, their landlord took the couple to court in an attempt to evict the family. Their hearing has been postponed until March, thanks to the intervention of a lawyer. But Florina and her husband still fear they will be evicted, along with their working age children and young grandchild.

Florina is fortunate, she says, that she lives with children – her son, 39, works at a bakery and her daughter, 30, is a home-health aide. While their combined income does not pay for the increased rent on their apartment, being partially supported by a younger generation is not something all elder New Yorkers have.

Many elder New Yorkers without such family ties and with little retirement savings end up displaced, segregated to an adult home, or worse, shuffled into the city’s homeless shelter system when they become ill.

“Sadly a lot of older, disabled people believe ‘they can’t throw me out into the street’,” says Justin La Mort, a housing lawyer with the group Mobilization for Justice who works with elders. “The bad news is, in fact, they can. It’s just a matter of time.”

The city uses a patchwork of social services and subsidies to keep elders aging in place, but they can be difficult to qualify for and their funds are limited. For those without savings or income from work, federal programs—SSI, SSDI or social security—can come too late and, when they do arrive, may not meet the high cost of rent in New York City. The result is a permanent sense of precarity among the city’s most vulnerable, sometimes culminating in homelessness or displacement.

A lack of retirement savings compounds the problem. According to the commissioner of the city’s Department of Consumer Affairs, half of New Yorkers 55 and older have no money in traditional retirement accounts. 40 percent of New Yorkers between 50 and 64 have less than $10,000 saved in such accounts. Nationally, 29 percent of adults above 55 have neither a pension nor retirement savings, according to the Government Accountability Office.

This lack of assets can have material effects when older adults face hardships: a recent study from the non-profit Robin Hood looked at material hardship, spurred by housing insecurity, job loss or illness. The study found that 53 percent of New Yorkers experienced such hardship for at least one year in the survey’s four year timespan.

According to the same report, 23 percent of respondents experienced poor health between 2012-2018. The study also found housing subsidies and rent regulations had reduced the poverty rate by 5 percent.

Elders who become disabled suddenly can find themselves in a grey area where social services can’t help them. Awaiting disability benefits, for which they may be rejected, they could find themselves in arrears and face evicted for unpaid rent. Still others who receive Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI) may be surprised to learn that their income is less than what they owe in rent but too much to qualify for a city or state subsidies to prevent homelessness.

Income supports don’t match up with rent

As City Limits has reported, the percentage of older adults in New York City’s shelter population is increasing. There is no way to determine how many elders become homeless each day through eviction, as eviction data made public by the city does not include age as a data point. While the number of adults in city shelters who are age 65 and above increased 300 percent between 2004 and 2017, older adults who are evicted don’t always enter shelter. And seniors don’t have to be formally evicted to be displaced by the threat of eviction; if they move out ahead of being uprooted by a marshal, or take a buyout, the result can be the same. Few elders are fortunate enough to find more affordable housing in the city, and some are forced to relocate to other states.

Evictions have been decreasing overall across New York City, thanks to a raft of pro-tenant legislation that closed loopholes for regulated apartments and provide access to counsel. Evictions executed by city marshals decreased 25 percent between January 2019 and January 2020. But for tenants who can no longer gain any income from work because they are elderly or disabled, eviction or displacement are more difficult to put off.

For an elder who has lost the ability to work, income supports are crucial. Social Security Insurance, payments based on age or disability and meant for people with limited income, and Social Security Disability Insurance (which makes payments to disabled persons based on their earnings record), have not gone up proportionally with rent in New York or across the country.

“The challenge that you see with a lot of senior citizens is they have fixed incomes. Their Social Security isn’t going up,” La Mort says.

In December 2019, the average monthly SSDI payment was $1,419, well below the $2,150 average cost of a one-bedroom in the New York City. The program also has a five month waiting period.

SSI, a welfare program with less generous payments, maxes out at $858 in New York State —for a person living alone and $1261 for a couple. And social security, which differs based on work history, paid an average of $1,384 a month to Americans in January 2020.

There’s no certainty that SSI or SSDI will be approved or that they will arrive in time to prevent eviction.

“The outcome of disability applications can be a little hard to predict, if not random,” says Alexander Ryley, Director of Elder Law at Legal Aid Society’s unit. “You can have someone who submits an application, it’s denied, then they potentially have no income from that source for years. So what the heck do they do in the meantime?,” he says.

Ryley said one of his clients, a home-health aide who eventually could no longer work due to arthritis, applied for disability and was approved, but needed to pay rent while the approval process was ongoing. She was able to get payments of a hundred dollars each month through a non-profit called The Bridge Fund.

Maria Toledo, Director of The Bridge Fund, says the non-profit offers short-term subsidies to seniors who are struggling to pay rent, and who will be able to manage themselves financially in the near future. Often, this means creating a bridge between illness and social security payments. The non-profit, which is funded privately, mostly has clients who are among the working poor and ineligible for vouchers from government programs.

But because of limited funds, they turn away clients without the means to eventually support themselves.

“These are folks that worked all their lives, and tried to do the right thing, but they never made enough money to save for retirement,” she says of people they turn away. Others qualify for help from the Fund but need the subsidy for longer than they’re able to provide.

Toledo says last year’s reforms to the rent laws have not reduced the amount of people coming to her unable to pay rent and without any savings to draw from. She says the city should consider expanding its vouchers to this population, and that for folks who are younger, the Mayor’s plan to create a public retirement system is a helpful start.

“We just need to do more,” she says.

Rent exemptions exist but are imperfect

Two city programs intended to freeze the rents of disabled and elderly tenants who live in rent-regulated apartments have been useful, but advocates say they have significant gaps and don’t meet the need. Senior Citizens Rent Increase Exemption, or SCRIE, and Disability Rent Increase Exemption, SCRIE are supplements paid to landlords by the city so that a tenant will pay no more than they did at the time of application.

SCRIE is available to elders who are at least 62 years of age and who make under $50,000 a year. The frozen rent must also be at least 30 percent of the tenant’s income – if it’s less than that at the time the tenant applies, they are denied. If a tenant’s income goes down while they are on SCRIE, they can ask for their rent to be readjusted downward, but the Department of Finance, which administers the program, doesn’t do anything to inform tenants about this process or adjust the rent automatically.

“If they were working and became disabled, the SCRIE or DRIE program is not going to help them much,” Ryley says.

Another challenge with the rent exemption programs is that tenants benefit from them more if they apply for it as soon as they become eligible, but many don’t learn about the program for years, at which point their regulated rent may have increased too much.

“If you can freeze your rent at 80 percent of your income it’s not inherently affordable, says Pete Kempner, an attorney at Volunteers of Legal Service, a non-profit offering pro bono lawyers. Kempner suggests that the city expand the program by offering it to tenants in unregulated apartments and increasing the income threshold. He also suggests making it easier to roll back rents to when the tenant would have first qualified – which may have been 10 or 20 years in the past.

Adult Protective Services helps—if they know

While the city has made an effort to prevent homelessness among its seniors with disabilities, carrying out an eviction on an elderly person with a disability is legal for landlords to do.

For people like Margaret, 70, programs like SCRIE or DRIE also provide no help, as they only apply to regulated units. Margaret has been living in the same unregulated unit in Flatbush since 1992 and is in the process of being evicted by her landlord. She asked that her real name not be used for fear it could lead to retaliation from the landlord. After years of what she says are poor conditions – which include mice, roaches, excessive water damage, and the use of the building’s basement for junk storage, she began making complaints to 311. After the city sent an inspector, she says, her landlord began serving eviction notices, she says as retaliation.

“We had a very good relationship. We were like a family,” she says. “From the time I start to complain, he gets funny with me.”

Because retaliatory evictions are difficult to prove, her lawyer, Alex Ryley from Legal Aid Society says, she’s been trying to look for other affordable senior housing in New York City. If that takes too long, she has considered a move to Delaware, where she has some family.

Margaret has been receiving worker’s compensation since she had an injury to her shoulder in 2017. The amount has decreased, she says, and now she gets $300 every two weeks. She also receives $1440 a month in social security, which allowed her to pay the modest $1050 a month for her 1 bedroom apartment. She’s unable to go back to work as a home health aide because of the injury.

Because her housing conditions are so bad, she says, she stopped paying rent last July. She hopes to work out a deal in court to use the money she has saved to move somewhere else, but still worries about her savings.

“The landlord can do whatever they want,” she says. “If I make a complaint, he retaliates.”

One of the city’s few guardrails to keep disabled seniors in their homes is a requirement that Adult Protective Services, a case management office within the city’s Human Resources Administration, be notified before a tenant who is elderly or disabled is evicted, even if that tenant has no active case. . If the landlord is aware that the tenant is a senior or disabled, they’re required to notify the marshal carrying out the eviction, who must then contact Adult Protective Services. If APS becomes involved, they can evaluate the tenant, delaying the eviction by two weeks and possibly connecting them with other city programs

In late January, when City Limits visited Queens Civic Court’s housing offices on the building’s 4th floor, this dynamic was on display. As in all of the borough housing courts, city -funded housing lawyers have occupied an office here, where they meet with clients and frantically weave in and out of courtrooms. But in some cases where the tenant does not show up, landlords can still have the upper hand.

In one case, a landlord filed for an eviction notice for a household in 106th Street in Corona. The judge asked the landlord whether there were any elderly or disabled people in the home. The landlord, who said she had an informal agreement with her tenant to rent out a floor in a three-family home, said that one tenant was in their sixties, but she was unaware if they were disabled. The judge granted the warrant of eviction, without asking the landlord to contact the marshal about the tenant’s age.

City vouchers are often out of reach

Among the subsidies available to adults facing eviction are Family Homelessness Eviction Prevention Supplement, or FHEPS, a supplement that applies to families with children who already receive cash assistance or who are leaving a homeless shelter. The supplement, which is paid by the city to landlords, potentially lasts up to five years.

But most seniors, particularly those who suddenly stopped working due to disability, will not have already been receiving cash assistance nor do they have children under 18 in their household. CityFHEPS, another rental supplement for people not already on cash assistance, has more stringent requirements. Tenants must be making less than 200 percent of the federal poverty level. If they meet that requirement, they must either live in a rent-controlled apartment—a rarity—prove they are a veteran, or present a letter from Adult Protective Services in their support. But APS is strict about providing such letters. And neither of these subsidies have kept apace with the rise in rent in New York City.

Seniors, like all New Yorkers facing eviction, could receive assistance through the Special One-Time Assistance (SOTA) supplement, which pays up to a year’s rent up front. They’re also eligible for the Human Resource Administration’s “One Shot Deal” emergency payments. If they’re still unable to pay rent, HRA will often direct them to Homebase, a sub-agency of the Department of Social Services that handles homelessness prevention and guides tenants through available options for assistance.

Homebase, which was created under Bloomberg and saw its funding increase under De Blasio, partners with non-profits in different boroughs to provide short-term rental subsidies, financial management workshops and case management. Homebase screens applicants to see what they can qualify for, even though not everyone can benefit from vouchers.

“Some people for sure are falling through the cracks,” says Nakeeb Siddique, the Director of Housing at the Legal Aid Society’s Brooklyn Neighborhood Office.

“One of the hooks to all of these programs, to all of these subsidies, is you have to have a housing emergency,” he says, which usually means a formal eviction proceeding. But some people leave their homes as soon as the landlord initiates the eviction process without seeking a court date. Still others just don’t fit the rubric of existing vouchers.

“I’ve had cases like that myself where the person could use the rental subsidy that would be the key to solving the problem,” he says, but the person is ineligible.

A lack of counsel is still an issue

Compounding these problems, many are not in touch with housing lawyers who are in a position to help them. The city does provide housing lawyers to low-income people facing eviction in select zip codes through its Right To Counsel program. It has also for years provided lawyers for low-income elderly people through a separate program. But neither program has comprehensive reach.

Donna Dougherty, Attorney-In-Charge of legal services for the elderly for JASA, a social-services agency, says that in circumstances where elders are facing eviction, housing lawyers try to work with judges and landlords to find a solution. Often the landlord doesn’t want to evict a longtime tenant, and courts have been more amenable to keep seniors in place in recent years and will work toward solutions.

“It’s more of trying to piece together a plan, so that I can help the client afford the rent going forward,” she says.

Nevertheless, “there are limits to what a legal provider can do,” she says, and people can fall through the holes in the city’s safety net if they don’t qualify for any of the available vouchers.

One reason for that is that the city prioritizes people actively in a housing emergency, meaning that vouchers are provided to people who are actively in eviction proceedings. But many people, upon getting a notice from the landlord, leave before eviction proceedings are filed.

Others are just never connected to social services, because they don’t go to housing court and have not yet entered shelter, the two main channels where people are connected to housing support.

There have been some improvements. Last year’s new rent laws were a gamechanger, says Pete Kempner of Volunteers of Legal Service, which provides pro bono representation. . Before last summer, he says, landlords were putting more pressure on elderly tenants to leave, but many of their incentives to force out tenants in regulated units have been removed. And notably, courts were granted leeway to provide up to one year for a tenant to find new housing if they are in eviction proceedings.

Florina and her husband, the couple from in the Bronx who are on rent strike, live in a building with other seniors. Records show multiple complaints about conditions

When asked, Florina says she isn’t sure if the landlords are familiar with her husband’s disability.

“I’m not sure what’s going to happen to me,” she said through a translator. “I’m not sure if I have to find another place yet or not.”

2 thoughts on “Many NYC Seniors Still Face the Threat of Evictions”

Excellent article – can you fix the typo in the title – Still not Sill.

I think this system sucks it always tries to undermine the good people try to do for oneself and I wish it wasn’t so biased. Trying to find an apt in NYC ain’t easy. And then they prejudiced against women over 40 who doesn’t have dependents. They try an make single people do so much darn work. Then you pays more in taxes. Then it’s not enough to live on an fund transportation other than buses an trains. They must think all women work for their Health,