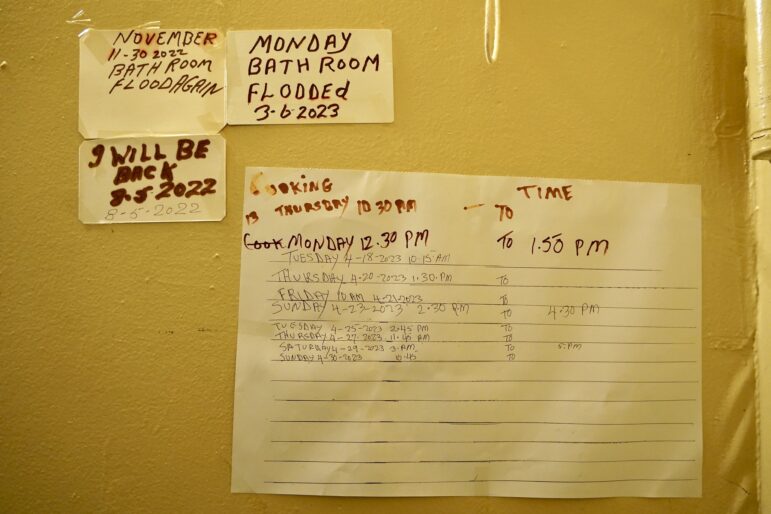

Adi Talwar

Ken Carlino with his mother at her apartment in Queens.

In July of 2017, Ken Carlino’s 86-year-old mother stopped eating. She spent three days in the hospital, and lost 10 pounds, which left the already frail elder even weaker.

Carlino and is siblings saw that their mother’s savings were scant and that if she paid off her credit card debt she’d be eligible for Medicaid. After some reluctance, she agreed to pay down the debt and apply for Medicaid that August. Carlino sent in a request for the expedited program on her behalf. She received a letter of approval two months later in late October of 2017.

“That’s when I started getting paid,” says Carlino, a consultant and former city employee in his mid 50’s who effectively became a full-time caretaker to his mother.

For family members who need long-term caregiving, programs like the state’s Paid Family Leave will not suffice. “In general, long-term care needs come up after some kind of trigger or illness,” says Maria Hunter, Director of the Public Benefits Unit at New York Legal Assistance Group.

The version of Medicaid the Carlino family used, the Consumer Directed Personal Assistance Program or CDPAP, is a 32-year-old program that pays—and provides supplies for—home-health aides who are selected by a family caregiver. Family caregivers can also be paid to care for loved ones directly.

But the system is notoriously convoluted, filled with exemptions and rules that are constantly in flux, and still adjusting to a changeover to a partially privatized system in 2012, an attempt by Governor Cuomo to root out misspending.

The governor has announced new changes to the program as part of his proposed budget that have advocates up in arms.

A new role for private parties

City residents once could select home care agencies contracted by the city’s Human Resources Agency, paid on a fee for service basis. Now they must be routed through NY State and forced to select a “Managed Long Term Care” plan, policies run by private insurance companies* empowered to determine how many hours of care their clients receive, despite being paid a flat rate by Medicaid (The current New York City rate is $5,036* a month per enrollee).

This means insurance companies* have an incentive to pay for less care, as detailed in a series of New York Times articles.

Consumer advocates have been raising alarms and trying their best to keep their clients up to date. A website called NY Health Access, a tip site for health consumers, was launched by advocates including NYLAG, The Legal Aid Society and Empire Justice Center. The site states that, “Consumer advocates are concerned that the State has not clearly required plans to provide personal care… in the same amount, duration, and scope,” as is required by public plans like HRA.

Carlino, a former city employee who now works as a consultant, was surprised at the discrepancy in hours between the two systems. HRA did an assessment of Ken’s mother in her home and approved her for 24-hour care, to his surprise. The hours from HRA were so generous, Ken says, that he was worried that his mother’s condition was worse than he thought.

“I thought I was being neglectful,” he says. Eventually, HRA reduced his mother’s hours to 70 hours a week, at his request.

But as his mother received this care, the state’s Medicaid program sent a letter to Carlino’s mother and told her to select a Managed Long Term Care plan within 60 days, or a plan would be chosen for her.

When a nurse from one of the MLTC plans evaluated Ken’s mother, she was offered four hours a day – a stark reduction from what she was getting under the city’s care. Carlino turned down that provider.

Complex rules

He never chose an MLTC plan through New York State’s Medicaid system and was able to stay on HRA’s plan, a quirk of an expedited process he used to get his mother called an Immediate Needs Procedure.

Even if he had switched to a private plan and they had reduced his hours, Carlino would have been able to keep his original hours for 90 days under the law. And after that, he could appeal and would likely win back the more robust hours, according to Valerie Bogart, Director of the Evelyn Frank Legal Resources Program at NYLAG.

“It’s a due process issue,” Bogart says. The MLTC plan is required to send written notice justifying the reduction in hours and explaining appeal rights, the result of a 1996 federal court decision.**

The rules are obtuse, which is why it helps to have an attorney to navigate a complicated system and get their loved ones the best care.

Ms. King (whose story City Limits featured in a related article, and did not want her name used to protect her mother’s privacy) says she would not have otherwise known that caregivers using CDPAP can bring in as many home-care agencies to evaluate her mother as possible during the 60-day window between her approval for CDPAP and the deadline for choosing a provider.

The MLTC plan King selected, Wellcare, provided her with medical supplies – gloves, incontinence supplies, IV’s and paid the intermediary. The aides were people that King hired herself through personal references, and they had already been working for her for a year while she paid them out of pocket. One had been a caregiver to a friend’s father, for instance.

CDPAP pays wages similar to what a home-health aide makes in New York State, which at the time was $13, though King paid a bit more out of pocket to make out the difference between the aides’ private wages and the Medicaid wage.

King says the biggest challenges were the delays in getting approval and the time crunch to choose an MLTC once she got a letter from Medicaid.

“It’s a landmine of a system, and as you’re learning, time is ticking,” she says.

Each MLTC that sent a nurse to evaluate her mother became a stress-point, as she worried about getting a number of hours suitable to her needs and dealt with her mother’s discomfort at having strangers in her home.

King tried to figure out back-up plans as the first two long-term care providers that evaluated her mother and offered hours short of what she needed. She finally received the hours she needed from the third MLTC plan that came to the house. Then she needed to secure a letter from a physician and provide the paperwork before a 60-day window had closed.

She says that since this initial application process, she’s been well-served by the aides she selected and by Medicaid. But there are still rules she finds troubling: She couldn’t easily bring in new aides in case one of her aides got sick, which turned out to be an issue several times. One aide had to have surgery. One had to leave the country. King was able to find flexibility in her remaining aides, she says, but she was lucky.

Because the process of navigating Medicaid and Medicare while caring for a loved one is onerous, NYLAG lawyers come prepared. They ask for all sources of incomes and assets.

“It’s really truly a labyrinth,” NYLAG’s Maria Hunter says of the process. Many who come to NYLAG have received what they think is a denial, but are unaware that they can rearrange or spend down their assets and reapply or go through an appeal. And there is a long list of excluded income sources that can also help them meet the threshold.

Get the best of City Limits news in your inbox.

Select any of our free weekly newsletters and stay informed on the latest policy-focused, independent news.

None of the routes are easy or quick, Hunter says. The system is riddled with delays and can take up to six months, which makes Paid Family Leave, still relatively unknown to caregivers, particularly useful.

Because of her Immediate Need designation, Carlino’s mother had her Medicaid process managed by the city’s Human Resources Administration rather than the private managed care providers that the state mandates.

Carlino settled into a routine of caring for his mother three days a week, with other aides taking over the rest of the hours. But as of this year, Carlino’s mother is no longer on CDPAP, he says, a result of an argument with his siblings over whether his mother needed it. He struggles with his siblings and his mother over the appropriate amount of care. She has ongoing anxiety and depression, Carlino says, that contributes to the need to have an aide constantly at her bedside.

Editor’s Note: The article has been corrected (*) to reflect that it is MLTC insurance plans that can make decisions about a client’s hours, not home care companies, and to update the Medicaid payment per enrollee. It has also been edited (**) to clarify that MLTC plans can legally reduce hours, but not without justification.

Support for this article was provided by Rise Local, a project of New America NYC.