New Yorkers who owe back rent can once again apply for the Emergency Rental Assistance Program (ERAP) after a judge ordered the state to reopen applications, citing what could be a substantial second round of funding in March. But the federal government has yet to approve a new round of cash for the tapped-out fund, and eviction protections end Saturday.

Sadef Kully

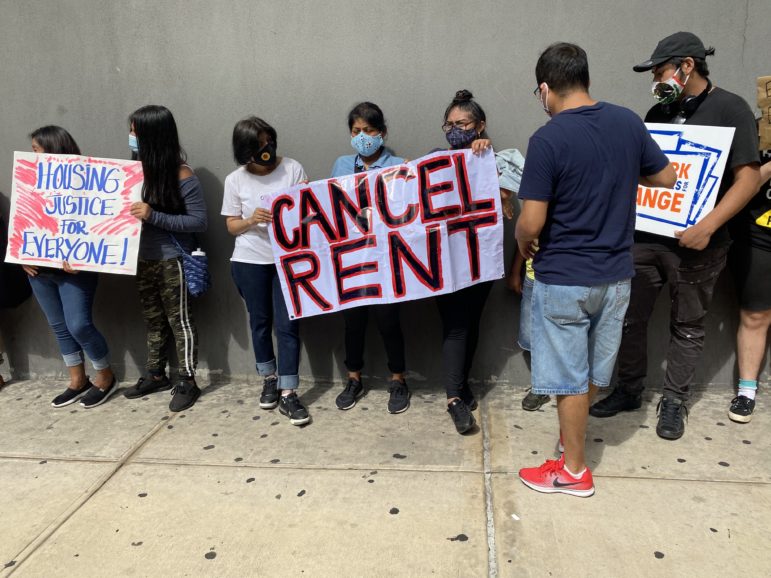

The scene from a 2020 protest by Housing Justice for All.Gov. Kathy Hochul is once again urging the federal government to replenish New York’s tapped-out rent relief fund after more than 1,300 additional households applied to the state’s reactivated assistance program.

New York’s expansive pandemic eviction protections will expire Saturday, Jan. 15, but Hochul has said she will not seek to prolong the prohibition on most evictions that began in March 2020. While grassroots tenant groups have pushed for a wintertime eviction suspension, state lawmakers have backed off calls for another extension.

Instead, leaders have pointed to other ways to curb evictions in New York City, including state rent relief and municipal grants, known as one-shot deals, to cover back rent and a right to an attorney for low-income tenants who are at risk of losing their homes.

In a letter Thursday, Hochul joined governors of New Jersey, California and Illinois to ask U.S. Treasury Secretary Janet Yellen to streamline the allocation of a second round of Emergency Rental Assistance Program (ERAP) funding to direct more money to landlords on behalf of tenants who fell behind on rent and are facing eviction.

New York and the other states “are facing an immediate need now, and unused emergency funding that is eligible for reallocation should be deployed in an accelerated manner to keep families stabilized and housed as we continue to address the current surge of COVID-19,” wrote Hochul and New Jersey Gov. Phil Murphy, California Gov. Gavin Newsome and Illinois Gov. JB Pritzker.

New York City Mayor Eric Adams also called on the federal government to replenish the rental assistance fund during a press conference outside Manhattan’s Housing Court Thursday.

“New York City has the highest rents in the nation,” Adams said. “The federal government must help working people in this state.”

The federal government provided an extra $27 million in ERAP funding to New York in December 2020, but that amount represented less than 3 percent of Hochul’s request for roughly $1 billion. The Treasury Department will soon reallocate some unused money that was part of its first ERAP allotment, known as ERA1, to states in need of additional rental assistance, but it is not clear how much New York will receive. Treasury will determine a second round of payments, known as ERA2, by the end of March.

Since June 2021, New York’s rent relief fund has directed cash to property owners on behalf of more than 100,000 households who owed arrears as a result of the pandemic and related economic crisis. That money has allowed landlords to recoup lost income, while preventing tens of thousands of potential evictions.

But Hochul and the state’s Office of Temporary and Disability Assistance (OTDA) decided to close the state’s ERAP portal in November after demand far outpaced the available cash. The program began in June with roughly $2.4 billion in reserve and has since received nearly 300,000 applications, leaving the state unable to pay out about 85,000 applicants.

New Yorkers who owe back rent can once again apply for ERAP funding, however. OTDA reactivated the application process at 10 p.m. Tuesday night after a state judge earlier this month ordered them to resume the process, citing what could be a substantial second round of funding in March.

An ERAP application also allows renters to delay or stave off an eviction because state law prohibits a judge from ordering an ERAP applicant out of their home until their eligibility is determined. By accepting the payment, property owners agree not to evict a tenant for at least a year.

To qualify for ERAP funding, renters must earn less than 120 percent of Area Median Income (AMI)—$128,880 for a family of three in New York City—and owe arrears dating back no earlier than March 13, 2020.

The vast majority of ERAP applicants have been among the lowest income residents of New York. Statewide, about 69 percent reported earning less than 30 percent of AMI, or $32,200 for a family of three, according to OTDA reports. Another 20 percent earn between 30 and 50 percent of AMI—no more than $53,700 for a family of three in the city.

Far more New Yorkers are at risk of eviction, but have not applied for assistance.

A recent survey by the Community Service Society of New York (a City Limits funder) found that one in four low-income tenants are behind on their rent, with Black and Latino women at the highest risk of eviction. At the same time, rents have risen for more than 40 percent of low-income respondents, CSSNY found.

Echoing the initial glitchy launch of the program last year, new applicants said they one again encountered technical errors when attempting to complete the process in the hours after its relaunch this week. Yet more than 1,300 managed to send their submissions in anyway, OTDA said.

Legal Aid Society housing attorney Ellen Davidson said that number, despite confusion and some glitches, illustrates the dire need for rental assistance statewide. “Sadly, tenants learned about the program after it closed and they applied as soon as it reopened,” Davidson said.

She said Legal Aid and other legal service providers have advised tenants at risk of eviction to respond to court papers and connect with an attorney to navigate a complex process—even if a tenant has already been served with a warrant by a marshal.

“All hope is not lost for these tenants,” Davidson said. “They need to reach out to the courts, get an attorney and come up with a way to resolve the case.”

18 thoughts on “1,300 Households Apply for Reopened Rent Relief Portal as NY’s Eviction Freeze Nears End”

Even Hochul realized that ultimately the SCOTUS would toss the NYS Eviction Moratorium as unconstitutional. The moratorium effectively forced owners of private property to provide free housing for their tenants at the order of the state of New York, which is a taking of that private property. By what stretch of the imagination can a law like that be considered constitutional?

So end all covid mania because that’s completely unconstitutional. And more so than rent moratorium. Tenants deserve protection.

No one is forcing landlords to continue to be landlords.

I have the lowest form of life living in my house and can’t get them out until this earp Denys them they have been living in my house rent and utility free for a year what kind of city is this ? One that protects low life’s pathetic city

Adams said ‘ny has highest rents’. He should lower taxes. Landlords and Employers have too many protections.

it not fair for Subside housing peoples to wait i’m a sungle mothe i applied for the program in july they said it would take 6 weeks and now it’s been 8 months

Have you received a payment yet?

It’s a complete mess. I have tenants who applied in August and September 2021. absolutely no status (I call every week). They should just lay off everyone working on this program because they are just sitting around doing nothing now- while we cross fingers that Janet Yellen will approve more money in late March.

I also have not received my payment for the erap assistance and i.appkied back around October 6

I applied since June 2021 nothing status says no orothy

My father will be 90 on Friday and in March 2022 his tenants will owe 6 months’ rent. Shame on you NYS, leaders are getting paid to do what … just talk …….. and ask for federal funds to then waste it and not use it for its intent. What the heck is taking so long …. Please! answers!

As the ERAP states it will pay for 15 months and the tenants need to know this. ERAP will pay up to 12 months back rent and 3 months forward from time of applying for application. Beyond that the tenant must pay the rent on the 4th month after the application. The tenant is protected for one year after the application and landlord agrees to it. This does not protect tenants from not paying rent. Landlord can sue for the rent if not paid beyond the 3 months after applying.

Currently ERAP is out of funds since 9/21/21.

Lets not forget if the landlord wants the apartment for personal use. They can take them to court and evict.

It’s been (8) months these low life tenets haven’t paid a dime . I’m in the whole for $20k . What do I tell my mortgage company and suffolk county tax department , I’m waiting for ERAP money . They dont give a shit and late fees and interest is adding up . I just want the low life tenets out . There are hard working people who want to work and pay rent . this program is a same, and after I get the ERAP money I can’t kick them out for a year, yeaaaa ok the whole system is bullshit . There are jobs open everywhere and everyone is hiring , these low life’s are using the system. They just don’t wanna work. I can’t wait to get rid of these low lives .

Renters who cannot pay back rent because of loss of income are not low lives or at fault. Landlords want to blame renters, but many renters owe rent because of a once in a lifetime global pandemic. Anyone who tries to forget this is insane. I like other renters paid our rent on time for years. Then Covid happened. The affect of Covid has been a nightmare for employment. Landlords and people who clearly don’t know any better always say the same thing “there’s jobs everywhere” or “they just don’t want to work” – which is so unbelievably wrong. I like many many others looked for work tirelessly for over a year and was only able to find a job after more than 12 months of searching. When I started my new job, everyone else that was also a new hire shared a similar job search experience. There has been so many advertisements and posts on job boards for businesses looking for work, but they are not really hiring, it’s only so they don’t have to give back the money they were given during the pandemic that requires them to look for workers. Hochul, Yellen, and whomever else need to focus on securing ERAP funding, because it’s true landlords do deserve to receive their money, similarly to how tenants deserve funding to cover rent they could not pay because a global pandemic made it impossible for them to do so. One side is not necessarily better or at no fault than the other, and that’s what people seem to frequently forget. Landlords sure didn’t mind having tenants for years that paid their rent on time and gave them no problems, but a once in a lifetime pandemic occurs and that same tenant faces difficulty, and all those years of loyalty and being a good tenant seem to just go out the window for some landlords it seems. The irony in all this is that those same landlords then bemoan to their banks how they can’t make their mortgage payments because a once in a lifetime pandemic has affected their money flow, and yet, they have zero compassion for tenants in the SAME SITUATION. Hopefully, the ERAP funding comes in soon so those landlords can buy themselves some much needed perspective.

You forgot about all the enhanced unemployment benefits and stimulus payments these deadbeats got. They were getting their pay plus about an extra 300 a week. So theres no reason they should be behind on rent. Most people were making more by being unemployed during the pandemic than before. And most people are upset that that this loophole is preventing the only recourse a landlord has. Where as a tenant they are given basically every benefit.

Unfortunately I agree with both there are a bunch of deadbeats tenants no doubt that are taking advantage. I deal with a lot of them. Unfortunately the system is a mess. I noticed tenants in the neighborhood driving new Mercedes Benz and BMW and have the nerves to applied and get approved by Erap, at the cost of us paying taxes. On the other hand most of of tenants that i deal with always paid their rent on time before and during the pandemic attempted to do partial payments but if you are paying $2800 a month and getting 1200 a month to survive how can you or anyone can keep up with rent, utilities and food. Also those who were ill during months.

These tenants are working and not paying rent while applying for the ERAP program that allows them not to be evicted by the court from the landlord’s property. The landlord bears the liability, there is no bank in the land that cares about why a landlord can’t pay their mortgage. The banks are reporting landlords to the credit bureau to ruin their credit and they are taking steps to foreclose on their property; while tenants live rent free in our property. Why would NYS allow tenants to apply for ERAP in January 2022, when there is no money in the system to distribute…they did this purposefully so landlords cant take action on evictions — this was just another loophole NY State provided for tenants to live for free without any recourse for landlords. In the interim, landlords are using their life savings to cover the mortgage so their tenants can live rent free.