Upstate Downstate Alliance

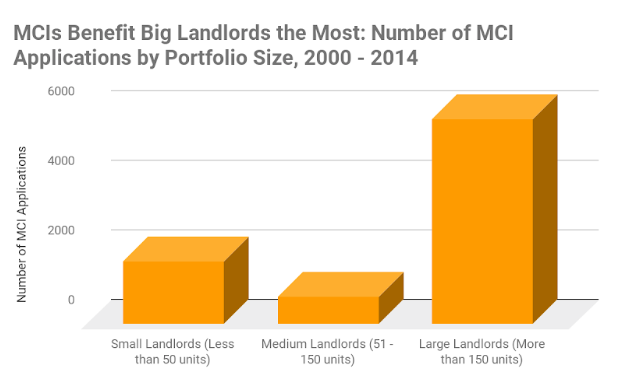

Tenant groups claim MCIs primarily benefit large owners.

With five days left until rent regulations affecting 2 million New Yorkers expire, tenant advocates on Tuesday offered a detailed critique of the major capital improvements program.

Major capital improvements, or MCIs, have been a primary point of contention during this year’s debate over whether to change the regulations affecting about 1 million rent-stabilized apartments in New York City, as well as stabilized housing in Nassau, Rockland and Westchester Counties.

Tenant advocates and their allies in the legislature want to get rid of MCIs, which permit landlords to permanently raise rents after building-wide repairs to roofs, boilers, elevators and other infrastructure. In the white paper released Tuesday, authors from the Upstate-Downstate Alliance said MCIs are just “one of several tactics that landlords exploit to raise rents and drive displacement.”

The Democratic majorities in the state Senate and Assembly support bills that eliminate MCIs. But Gov. Cuomo supports reforming, not revoking, the mechanism. Mayor de Blasio has also stopped short of advocating an end to MCIs, instead calling for them to be temporary—imposed for long enough for the owner to recoup his investment. MCIs were temporary during the early days of the stabilization program, from 1969 to 1984.

Property owners say MCIs fund necessary investment in the upkeep of buildings, and a driver of employment: The landlord lobby has organized demonstrations by building contractors arguing that ending MCIs would take money out of working people’s pockets.

Get the best of City Limits news in your inbox.

Select any of our free weekly newsletters and stay informed on the latest policy-focused, independent news.

But the data suggest MCIs are not a primary factor in housing investment.

According to research produced this Spring by the Real-Estate Board of New York’s lobbying arm, Taxpayers for an Affordable New York, in 2017 MCIs generated $283 million in economic activity. But they were approved for only 0.1 percent of stabilized units. An earlier report for the Rent Stabilization Association by the Urbanomics firm found that in 2014, MCI’s represented just 1 percent of the $10.05 billion that landlords invested in their buildings that year.

All this suggests that “MCI jobs are a tiny piece of the pie,” according to the Upstate-Downstate Alliance. They dismissed the notion that landlords would stop investing in their properties without MCIs.

“Replacing boilers, roofs, windows, and other weatherizing work reduces operating and maintenance costs by improving energy efficiency, sometimes cutting heating bills by more than half,” the Alliance added. “Landlords don’t need to be doubly compensated for these cost savings.”

Property owners contend that the yearly rent increases authorized by the Rent Guidelines Board have failed to keep up with property owner costs. RGB reports, however, indicate that while expenses have tended to increase at a rate higher than rents, net operating income for owners has continued to increase, because the rent roll was larger than the expense tab to begin with.

According to this year’s RGB income and expense study, net operating income for landlords increased in 2016-17 for the 13th consecutive year—although only by 0.4 percent, the smallest margin since 2002-2003.