Abigail Savitch-Lew

One of the problem areas inside 1511 Sheridan Avenue in the Bronx.

“When I first moved here, it was a beautiful building. It was a jewel,” says Benjamin Warren, a tenant association leader at 1511 Sheridan Avenue in the western Bronx. That was forty years ago, back when there were chandeliers in the lobby and a landlord with whom you could share your complaints while out to lunch together, he recalls.

Since then, the rent-stabilized building with 222 apartments has fallen into stunning disrepair—with chipping paint in the lobby, a stench in the halls and elevators, open lead paint violations (meaning they have either yet to be corrected or re-inspected), and, according to Warren, out-of-order elevators, frequent leaks and plumbing problems.

But the problem exceeds simple neglect. In 2006, the building was bought with an overvalued mortgage by a partnership of private equity firms, including Vantage Properties and Norman Real Estate partners. Tenants were overcharged, the building run into the ground with months of sporadic heat and hot water, and eventually the property entered foreclosure proceedings, as reported by Mother Jones in 2014.

At the time, tenant advocates came up with a moniker for private equity firms that purchase numerous rent-stabilized buildings, often at inflated prices, with the hopes of displacing tenants by failing to maintain the building or other means, then bringing in higher-paying tenants: predatory equity.

According to Mother Jones, many such ventures ended in foreclosure after the recession, with investors themselves rarely footing the bill. But according to tenant advocates, the boom-and-bust cycle did not put an end to the predatory equity model of business. They say a new set of private equity firms are back with the same intentions—and 1511 Sheridan is a prime example.

The building was resold in 2015, then 2016, each time for steadily higher purchase prices. This March it sold to Asden Properties, the New-Jersey division of the international real-estate company Medallion, for $38.1 million—more than $14 million more than it sold for in 2015.

During that same time, the Rent Guidelines Board had imposed a two-rent freeze for rent-stabilized apartments; Last week the board approved a 1.25 percent increase. In other words, basic rental income alone will not be enough to make up for Asden’s added debt.

“What Asden is going to try to do is move as many residents out of the building as possible,” predicts Warren. “They’re going to come in—they’re doing these beautiful new apartments…they renovate them, put in a new bathroom, tear out the old walls” and then rent them out to new, higher-paying tenants, he says.

Warren says Asden is focusing on fixing up vacant apartments rather than conducting needed repairs for occupied ones. And organizers with CASA New Settlement say that upon buying the building, Asden immediately began trying to evict many tenants; Asden has initiated 46 cases, 41 of which are still active, in Bronx Housing Court.

One of those tenants, who spoke with City Limits on condition of anonymity, said she was facing eviction for allegedly failing to pay her rent for March, April and May, but was able to show City Limits her money order receipts for those three months. And this comes after she was overcharged more than $6,000 by the prior three landlords, according to documents from the New York State Division of Housing and Community Renewal, of which only about $1,900 had been paid back as of December.

“What we need is a permanent landlord—someone who is going to come into the building, and not take the building and keep it for 13 months and then collect the rent and move on,” says Warren.

Identifying the bad actors

Over the past few years, a coalition called Stabilizing NYC, which includes the Urban Justice Center, the Urban Homesteading Assistance Board, and sixteen neighborhood-based tenant advocacy organizations from St. Nick’s in Brooklyn to GOLES in Manhattan, have been working to identify landlords they believe practice a predatory equity business model. They have a list of buildings—159 so far and growing—that they contend are owned by predatory equity landlords, and in June they released a “top ten” list of predatory equity owners at a press conference held at City Hall.

While the Public Advocates’ “100 Worst Landlords” list is based on numbers of code violations, Stabilizing NYC’s list takes into account a wide range of factors designed to pinpoint landlords who, through legal or illegal, visible or less visible ways, have a predetermined business strategy of removing tenants.

“This coalition is focusing on owners that have larger portfolios and it’s part of their business model to buy into properties across multiple buildings and expand their portfolios and really raise their profits by the different mechanisms that we’ve identified as problematic,” says Keriann Pauls of the Urban Justice Center.

Properties owned by predatory equity landlords, according to the coalition, exhibit at least one of the five following criteria: a high debt-to-income ratio or low capitalization rate (meaning that the owner bought the building for more than the building’s expected rental income can support), high levels of tenant turnover, harassment, increasingly unaffordable rents, or poor physical conditions. Tenant anecdotes are also taken into account when identifying predatory equity landlords.

The coalition pays attention to both landlords already in the city’s spotlight, and others who may be slyer at escaping attention. Thanks to loopholes in state regulations—such as those that allow preferential rents or MCI rent increases—landlords can find myriad ways to raise rents and displace tenants without breaking rules. As says Melanie Wang of CAAAV Organizing Asian Communities, a member of Stabilizing NYC, of one owner on the list, “The landlord knows how to follow the letter of the law, but does so to create instability for the tenants.”

Asden, which bought the Bronx property in March, also fits that description. Its code violation count is not high enough to place it on the Public Advocate’s Worst Landlords list, but it has invested in a swelling inventory of Bronx properties, and its business strategy is clearly stated on its website.

“In Miami and New York, due to their exceedingly strong residential markets, a lower quality asset type will meet our goal of capturing value in rents and land. The influx of quality tenants to these vicinities lends to wholly stable and attractive HUD and affordable housing investments,” the company writes on its website, adding that it aims to “reposition units to high levels of efficiency, comfort and modernity in addition to scrutinizing and screening the tenant base,” and ultimately “be positioned to increase rental revenues.”

Asden did not respond to requests for comment.

An official watchlist

Stabilizing NYC would like to see the city officially track and target predatory equity landlords the way advocates are starting to do.

In June 2016, Stabilizing NYC worked with the City Council to introduce a bill that would require the Department of Housing, Preservation and Development (HPD) to publish a watchlist of predatory equity landlords. It would be similar to the Public Advocate’s list, but landlords would be identified as “moderate risk” or “high risk” based on a measurement of debt taken on by the owner as compared to building income, as well as specific levels of open violations, a complaint filed against the owner for harassment that was not dismissed as frivolous, a history of multiple flips over the past few years, and other factors.

A second bill would create a less favorable legal environment for landlords who take on more debt than their expected rental income should allow. For these landlords, in the event of a tenant’s complaint of harassment, it would be up to the landlord to prove innocence.

And a third would create another watchlist for banks and financial institutions that lend to predatory equity landlords. The bill would set up a task force consisting of tenant advocates, lenders and others to create criteria to place lenders on the list. The objective, says Pauls of the Urban Justice Center, would be to make lenders think about their client’s records and the complaints of their client’s tenants before issuing a mortgage.

The details of these bills are still being negotiated, but at a hearing last October, HPD expressed a number of concerns about the first two bills (the third has not yet been discussed), including the resource intensity of creating a watchlist—with a whole new unit in HPD likely to be required, and difficult issues obtaining confidential financial data, the agency says—and the risk of enacting too broad a definition of predatory equity that unfairly penalizes landlords.

“This bill seems to create a presumption of legal fault by owners based solely upon their financial transactions. There are many reasons why a building may not have sufficient income to cover its debt,” wrote HPD Deputy Commissioner Vito Mustaciuolo in testimony to the City Council. “A landlord might buy a building with the goal of doing energy efficiency improvements, which would lower expenses over time. The city should not disincentivize landlords from purchasing buildings with high operating expenses and trying to reduce those operating costs.”

Mustaciuolo also suggested that HPD’s existing Anti-Harassment and Certificate of No Harassment working group should study the relationship between overleveraging and harassment, and emphasized the number of initiatives already underway to combat practices used by landlords to drive out tenants.

City actions—deterring or driving?

The De Blasio administration and City Council have supported Stabilizing NYC’s work by providing the coalition’s entire budget—increased to $2.5 million in this year’s budget, over last year’s $2.25 million.

Yet many of the neighborhood-based organizations involved in Stabilizing NYC are also participating in rezoning discussions throughout the city, and are concerned that not only the whims of the market, but city-sponsored land-use decisions—both the choice to rezone a neighborhood, and not to rezone—are exacerbating this predatory activity.

Take R.A. Cohen & Associates, a real-estate investment firm that since 2011 has steadily acquired a growing portfolio of Chinatown properties. Melanie Wang of CAAAV Organizing Asian Communities says that in many of the firm’s buildings, they’re seeing the same trends: unsafe construction, maintenance problems, building-wide repairs that tenants do not always find improve building conditions (but do result in permanent rent increases for tenants), unnecessary eviction cases that force or encourage tenants to leave, and, in some cases, vacated units being rented out on a more temporary basis to a more wealthy and white demographic.

“Every day we don’t know what letter we’re going to receive, what the landlord is going to do,” says a tenant at 123 Madison Street, purchased by R.A. Cohen & Associates last year, who spoke to City Limits on condition of anonymity.

At 123 Madison Street, tenants’ concerns include many months without cooking gas, constant construction that leaves the air full of dust, invites roaches and mice, and has caused parts of walls and ceilings to collapse, disruptions of heat and hot water and attempts to evict each of the eight households in the building—most of them for allegedly failing to provide access to their apartments to allow for electrical rewiring. (Tenants, for their part, say they did their best to provide access, but were also frustrated that when they stayed home from work, sometimes no workers ever came. And some households say they were concerned about the safety of the construction work and had wanted additional information about the work to be done. R.A. Cohen & Associates did not respond to requests for comment.)

Although the tenants are receiving legal help and will likely stay in their apartments by negotiating access agreements, many feel the landlord is doing all he can to push them out—and some see this as part and parcel of the changes that the government seems to be allowing in the neighborhood.

“The government allows them to do all this,” says the 123 Madison Street tenant.

In the case of Chinatown, the government has not pushed development through a rezoning but has allowed it, according to some critics, by failing to adopt a rezoning of the entire Lower East Side that would limit building heights and create mandates for affordable housing. Wang believes the development of multiple towers on the Two Bridges waterfront, four blocks away from 123 Madison Street, is part of what’s driving speculation in Chinatown. And after hearing de Blasio speak at a recent town hall, she’s concerned the mayor may be underestimating the risks faced by rent-stabilized tenants.

“No one’s displacing the 400,000 people in the housing authority, no one’s displacing the people who are in rent stabilized housing,” the mayor said at that meeting. “We do lose some of it because of some things in the law that I would like to change on the state level, but in essence, if you’re in rent-stabilized housing you have real guarantees and what matters is the city controls how much the increases in your rent could be each year.” He added that the city is also providing legal services to protect tenants facing illegal harassment.

“That was confusing to us, especially as in the same town hall, he was talking to harassment protections in the neighborhood,” says Wang, referring to another part of the town hall when he and his commissioners acknowledged tenant harassment as a serious problem and noted a variety of initiatives to combat it. “I had heard that and felt honestly that he must be mixing his messaging a little bit.”

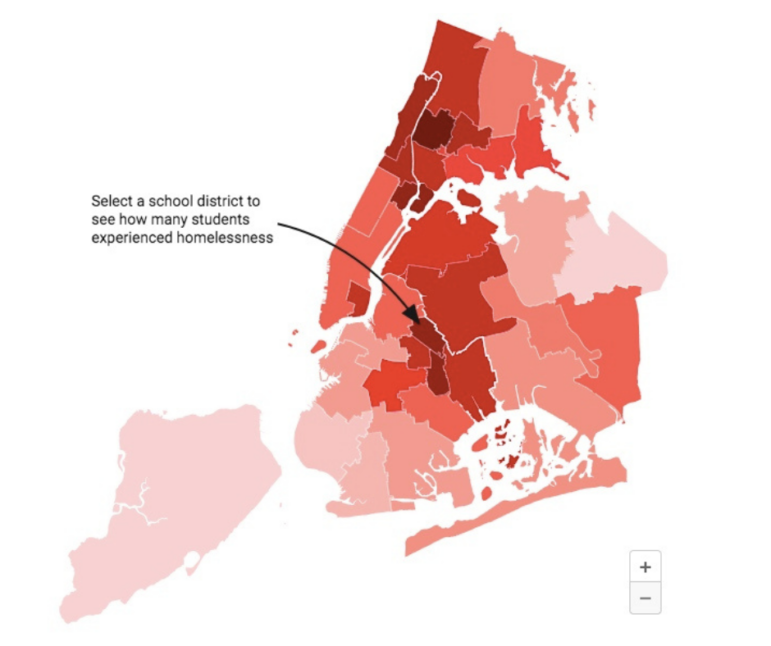

So far, the buildings that Stabilizing NYC has identified as owned by predatory equity landlords are concentrated mostly in central Brooklyn and much of the Bronx—including areas both with and without a rezoning on the table. Banana Kelly CIA Inc., the most recently joined member of the group, hopes to track predatory equity behavior in the Bronx’s Southern Boulevard area, where a rezoning study is underway and market-driven gentrification already abounds.

In an e-mail to City Limits, the administration stressed the number of initiatives already underway to curb illicit behavior by landlords, including the $100 million investment in a universal right to counsel in housing court for low-income tenants. In addition, HPD responds to complaints related to tenant harassment, holds tenant resource fairs to inform tenants of their rights and connect them to legal services, investigates landlords that are trying to deregulate apartments, is ramping up its code enforcement efforts, works with other government partners to investigate and penalize landlords involved in widespread harassment, and is part of an ongoing workforce to determine the feasibility of a citywide Certificate of No Harassment program. Beyond these law enforcement efforts, HPD is also working to offer various programs to landlords to encourage them to keep rents affordable.

“Since day one, this administration has zeroed in on the issue of tenant harassment, and is working on multiple fronts to protect tenants in rezoning neighborhoods, and indeed across the city, from owners that would try to displace residents from rent-stabilized buildings,” wrote Elizabeth Rohlfing, a representative for the Department of Housing, Preservation and Development (HPD) in an e-mail to City Limits. “Businesses that would engage in predatory equity are a threat, but by no means the only threat to rent-stabilized tenants, which is why the city is taking a broad and aggressive approach to combating harassment.”

Update: Following publication, Robert Cohen, president of R.A. Cohen & Associates, Inc., wrote in an e-mail to City Limits: “R.A. Cohen has a proud history of providing excellent service to tenants for more than 27 years. When we took over the management of 123 Madison Street, it was in extreme disrepair, with building systems that had not been maintained or replaced for many years. We have moved quickly to address these issues, prioritizing long overdue investments to ensure the building is safe and up to code. For example, old and dangerous gas lines led to gas service being shut off under previous management; we immediately moved to install new gas lines, offering tenants rent credit and cooktops in the interim. Similarly, we replaced the boiler and added new hot water heaters in response to widespread complaints about heat and hot water issues going back years. Every investment we have made is driven by one thing: the necessity to undue years of neglect and provide our tenants with the services and maintenance they had not received under prior management.”

3 thoughts on “Boom and Bust Have Gone, But ‘Predatory Equity’ Remains a Housing Threat, Say Advocates”

That is the Mayor’s MO—he claims he is protecting rent stabilized tenants–then the city sponsors large luxury buildings whose presence “subtly” encourages landlords in neighboring apartments to harass low paying tenants out. But no candidate for Mayor has emerged with a more intense fight predatory equity. So the many groups spreading up all over the city that are enraged by the Mayor’s policies and inflexibility will have to fend for themselves in the next four years.

Pingback: The ‘Mutant Rabid Gentrification Machine’ Comes For Elderly East Village Woman Paying $84 A Month – Gothamist

Pingback: ? Call for Crackdown on 'Rent Fraud' in Rezoning Neighborhoods ߷