There’s no question 421a has fueled development—nearly 117,000 units built since 2010 have qualified for the abatement. But over the past two years, the vast majority of income-restricted units were priced for people earning far more than the city median income.

Susan Watts/Office of New York City Comptroller

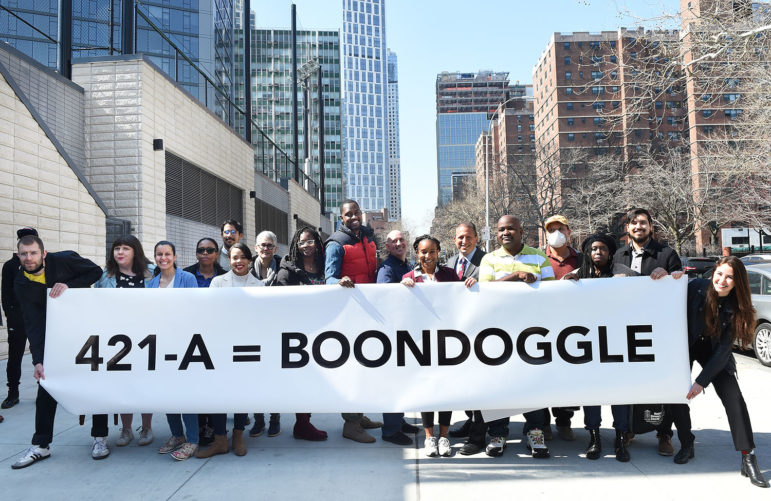

Advocates and members of the NYC Comptroller’s office at a rally calling for the end of the 421a replacement.Start with the consensus: New York City is in the midst of a years-long affordable housing crisis that has fueled mass homelessness and left hundreds of thousands of households paying half their income on rent. The city needs more apartments for low-income residents and wants developers to build them, but construction is expensive and rent revenue from affordable housing is limited compared to market-rate and luxury properties.

So how does New York incentivize affordable housing development without forfeiting too much revenue? That’s where it gets tricky, and where lawmakers and influential interest groups diverge as state budget negotiations enter a fevered home stretch.

The housing crunch has for decades given significant leverage to the real estate industry, allowing developers and building owners to extract massive property tax breaks in exchange for the creation of some income-restricted apartments. But just a fraction of those units are priced at levels that the average New York City household can afford, prompting criticism of the tax scheme, known as 421a, as a giveaway that diverts nearly $1.8 billion per year from the city, according to an analysis by the comptroller’s office.

With 421a set to expire in June, state lawmakers now have to decide on a path forward.

The issue remains one of the biggest wedges in Albany, as Gov. Kathy Hochul and leaders of the Senate and Assembly work to craft a final state budget. There’s no question 421a has fueled development—nearly 117,000 units built since 2010 have qualified for the abatement, according to a report by the Furman Center. But over the past two years, the vast majority of income-restricted units were priced for people earning six figures—far more than the city’s median income.

Hochul has acknowledged the lack of low-income housing development and proposed replacing 421a with a modified, though similar, tax abatement scheme known as 485w (like 421a, it is named for its location in the property tax code). The proposal has the support of Mayor Eric Adams, influential labor unions and the real estate industry. Progressive policymakers and tenant groups, on the other hand, want to kill any catch-all tax break and institute incentives for the creation of truly affordable housing.

The revised program appears unlikely to make it into the budget, due April 1, but three lawmakers who spoke to City Limits Thursday morning said anything was possible as the horse-trading intensifies leading up to the budget deadline—especially with bail law debates sucking up the internal oxygen and dominating public discourse.

“Nothing is definite yet,” said one lawmaker involved in negotiations.

What’s at stake

The 421-a tax exemption has been around in some form since 1971, when the cash-strapped city was eager to grease the wheels of new development in the five boroughs. In response, the state created a program to waive most of the property tax burden for developers of new residential buildings by allowing them to pay the pre-development rate. The program was revised in 2017 after it expired months earlier, with the new version billed as a way to incentivize needed affordable housing development.

That didn’t really happen. The program has largely subsidized luxury housing development with even income-targeted units priced higher than the surrounding area, according to a report released Tuesday by the Community Service Society of New York (CSS is a City Limits funder).

The reason is baked into the existing scheme. The current version of 421a gives developers three main affordability options, but nearly all of them choose the option of setting aside 30 percent of units for households earning 130 percent of area median income (AMI). That’s nearly $109,000 for an individual and almost $140,000 for a family of three in New York City—not rich, but not exactly low-income. The tax abatements last up to 30 years.

CSS compiled data from Department of Housing Preservation and Development statistics and found that developers built about 8,500 apartments with 421-a tax abatements between 2017 and 2021. Just 2,564 units were income-restricted, and about three-quarters of those were set aside for households earning 130 percent of AMI. Just 8 percent of the affordable apartments (and 3 percent of the total 421a units) were priced for people earning 30-50 percent of AMI. Less than 1 percent went to households earning under 30 percent, CSS found.

The report also found that most of those new 421a apartments were concentrated in rapidly gentrifying sections of the city, like Prospect Lefferts Gardens, Bedford-Stuyvesant and Bushwick. Just a fraction were affordable to the median renter in those areas, the authors noted.

The current 421a program has resulted in “‘affordable’ housing that, in many neighborhoods, is both too expensive for most neighborhood residents and more expensive than market-rate units for rent nearby,” wrote the report’s authors, Sam Stein and Debipriya Chatterjee.

They urged the state to revise the tax code and create tailored incentives for the production of affordable units rather than a one-size-fits-all approach.

Adi Talwar

A new way, or more of the same?

In her January State of the State address and policy book, Hochul acknowledged the failure of 421a to create deeply affordable housing.

Enter 485w.

Hochul says her proposal, included in her $216 billion Executive Budget plan, would fuel more low-income housing by eliminating the 130 percent AMI option.

The 485w program would instead compel developers of buildings with more than 30 units to price a quarter of their apartments for people earning less than 80 percent of AMI with mandatory tiers for lower-income renters. At least 10 percent must go to households earning 40 percent of AMI (about $43,000 for a family of three), at least 10 percent at 60 percent AMI ($64,440 for a family of three) and at least 5 percent at 80 percent of AMI (about $86,000 for a family of three).

The program would also require developers of buildings with fewer than 30 units to set aside 20 percent of their apartments for people earning no more than 90 percent of AMI ($96,600 for a family of three). That’s still far higher than low-income households can afford, critics of the proposal point out.

Still, the plan has many influential backers. In February testimony to the Senate’s Finance Committee, Mayor Adams said 485w would be a “critically important tool” to meet the city’s housing needs. The Real Estate Board of New York (REBNY) has used similar language, calling the revised plan “an important tool for producing rental housing at deeper levels of affordability permanently.”

Many Democrats may not care what Adams and REBNY think of the measure, but they will listen to organized labor. And influential unions have lined up publicly behind the 485w plan.The heads of 32BJ and the Building & Construction Trades, along with Adams, co-authored an op-ed backing the tax break in the Daily News Sunday.

The existing program is flawed but has “resulted in thousands of family-sustaining union jobs and delivered a ticket to the middle class to New York families,” they wrote. The proposed modification would continue wage standards for union workers and while creating more affordable housing, they added.

That stance makes it tougher on Democrats who count unions as a pillar of their base. “I think everyone is happy that labor is happy but there’s no real improvement to true affordable housing,” said one state lawmaker who asked to remain anonymous when discussing internal negotiations.

Lawmakers benefit from the opaque nature of the budget—an up or down vote on a massive spending and legislative package. That is also what makes the budget process so frustrating: Elected officials can avoid taking a public stand on crucial issues.

Nonetheless, many Democrats, particularly progressives, bashed the proposal in conference this week. Several have publicly assailed the 485w plan and demanded it be removed from the spending plan.

“We don’t need 485w, a fraud-ridden tax giveaway for the wealthy masquerading as an affordable housing program,” Queens Assemblymember Zohran Mamdani tweeted Monday.

Meanwhile, some affordable housing developers have also come out against the replacement.

“Governor Hochul’s … proposal is a sugar-coated version of 421a that is ultimately still a massive giveaway to luxury developers—not an affordable housing program,” wrote Association for Neighborhood and Affordable Housing Development’s Will Depoo in a blog post Sunday.

Taking the proposal out of the budget would set up a legislative showdown for later this spring, meaning it would remain a key issue in the final months of the legislative session, along with other housing proposals. Advocates hope to enact new eviction protections and fund a new rental subsidy that may or may not make it into the budget plan.

Removing 485w from the budget could also lead to a more nuanced approach to incentives through a long-desired tax code overhaul. Though that’s probably a pipe dream.

Until then, the Citizens Budget Commission wrote in a report March 15, “the need for an incentive will remain.”

State lawmakers will soon determine what that incentive looks like.