State lawmakers are taking a third pass at amending the rent relief program to reach more people, but some housing advocates – who are calling for the cancellation of rent– have slammed the legislation as putting the burden to getting assistance on tenants’ shoulders.

Sadef Kully

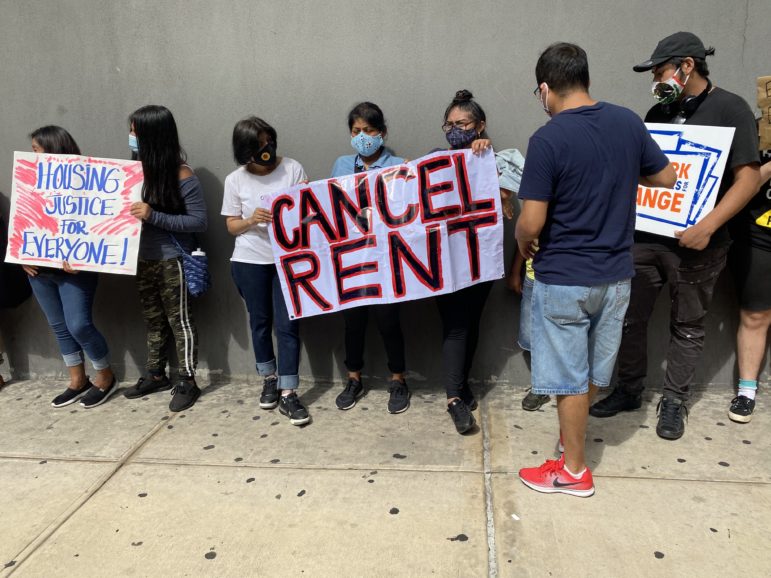

The scene from a June protest by Housing Justice for All. Many New Yorkers have had trouble paying the rent since the start of the pandemic, prompting calls for rent relief and better tenant protections. (Sadef Kully)Tenant and landlord advocacy groups are pushing state legislators for immediate financial help for households and property owners facing financial difficulties during the pandemic. Some state lawmakers, meanwhile, say they are awaiting federal funds from the Biden administration and preparing legislation for how to use that money towards housing and rent relief.

The mounting cost of rent arrears has pressured advocates and community groups to protest over the past few days outside of housing court and state legislators’ private residences. A September analysis, based largely on the Household Pulse Survey by the U.S. Census Bureau, estimated New York State could see between 800,000 to 1.23 million households unable to pay rent and at risk for eviction at the start of 2021, and facing rent debt between $2.5 to $3.4 billion. The office of State Senator Brian Kavanagh, who chairs the Senate’s Committee on Housing, Construction and Community Development, says the estimate is currently bordering $2.2 billion in rent debt.

Advocacy groups say the economic impact of the pandemic could be devastating for the state and city’s own recovery efforts. Tenant advocates assert that many tenants cannot pay landlords the rent, while landlord groups argue that they cannot afford to pay property taxes without rental income. Most recently, the city’s Comptroller analysis on the city’s preliminary budget showed a significant decline, by 4.3 percent, in the city’s property tax revenue – the largest drop since 1996.

Last May, the state legislature passed the Emergency Rent Relief Act (ERRA) of 2020 after receiving $100 million through the federal Coronavirus Aid, Relief and Economic Security (CARES) Act. The program, administered through the Department of Homes and Community Renewal (DCHR), was designed to aid rent-burdened households that lost income during the pandemic, but advocates say it’s eligibility criteria was too restrictive to reach those who needed it — it did not cover tenants who received unemployment or cash benefits, Section 8 Housing Choice Vouchers, public housing residents with rent more than 30 percent of their household income or those who earned more than 80 percent of area median income (which is $81,920 for a family of three).

Now, state lawmakers are making a third attempt to have rent relief reach more tenants quickly, with another piece of legislation being debated in the Senate this week (the Senate Housing Committee voted to move the bill to the Finance Committee on Tuesday.) The new bill,* sponsored by Kavanagh and Assemblymember Steven Cymbrowitz, will include the $1.3 billion allocated to New York for rent relief in the Trump administration’s December stimulus package, as well as the estimated $1.5 billion in aid that’s expected to be included in the Biden administration’s COVID relief package.

“If President [Biden] gets his stimulus package passed, the program that the Senator wrote also incorporates those funds. So a total of over $2.8 billion will be to rent, which we think will cover most of, if not all, of the rental risk that has occurred during the COVID period,” said Stanley Davis, a spokesperson for Kavanagh.

But tenant advocate groups have slammed the bill as spelling the end of the “cancel rent” movement in New York — an effort to have rent erased in full for eligible tenants and property owners, rather than paying it back through emergency funds. Kavanagh’s bill “would force tenants to fill out forms and beg and fight with other tenants to get rent relief,” argues the Crown Heights Tenant Union, which staged a protest against the bill outside the senator’s home last weekend.

They and other housing groups are calling instead for the passage of the COVID-19 Housing Relief and Recovery For All Act, also known as the Rent and Mortgage Cancellation Act of 2020, which would cancel rents and mortgage payments for the duration of the crisis, with some relief for landlords who demonstrate financial hardship due to the pandemic.

A slow start, and an amended rent relief program

The first rent relief legislation (ERRA) received $100 million in federal monies through the federal CARES Act when it was passed in March of last year. The rent relief program received nearly 83,000 completed applications online and an additional 11,000 paper applications. According to an October report, an estimated $40 million was distributed to more than 15,000 New York households this past summer – but another $60 million of the program’s funds went unspent.

Of those who applied for relief during the first round, more than 57,000 applicants received denial notices due to the program’s initial eligibility criteria, which required households to have been considered “rent burdened” — spending at least 30 percent of their monthly income on rent — prior to the pandemic in order to qualify.

The state legislature then extended the program with COVID Rent Relief Extension Program, and broadened the eligibility requirements for applicants after the Trump administration allocated an estimated $1.3 billion towards rent relief for New York State. Additionally, the program would allow those ineligible applications to be automatically reviewed under the new criteria, and renters had another shot to apply up until Feb. 1.

So far, DCHR received more than 15,000 additional completed applications from relief-seekers during that second round, in addition to the applications that were denied during the first round who may be eligible under the new criteria. Those applications are currently under review and awaiting approval, according to the state, and it’s not clear how many will be approved to receive aid payments.

The COVID-19 Emergency Rental Assistance Program (CERAP) bill* currently in the state legislature would look to open the program for another application period that would begin within 14 days of the effective date of the legislation, and would be available online and by phone for up to six months or until program funds have been fully used. Under this rent relief program, eligible applications would be approved to receive up to one year of rent arrears and utility arrears, with the possibility of an additional three months of rent and utilities if there is funding available for initial applicants. The bill is also being amended to include any leftover funding from the ERRA bill, estimated at $60 million, plus federal funding allocated for rent relief (the $1.3 billion from the Trump administration and an estimated $1.5 billion expected from the Biden administration’s COVID relief package.)

Households earning below 80 percent of the median income for their area that are facing COVID-19 related hardships and housing instability would be eligible, regardless of immigration status. It would prioritize households earning below 50 percent of the AMI, ($51,200 for a family of three) or those with long-term unemployment at the time of application, including households ranging from mobile home tenants, victims of domestic violence, tenants who apply jointly with their landlord, or those with pending eviction cases, according to Kavanagh’s office.

Landlords would be restricted from evicting eligible applicants, charging late fees on rental arrears, raising the rent or evicting the tenant for one year after they receive CERAP assistance.

The legislation would also include more flexible criteria for other existing rent assistance programs, which would allow more funding to be distributed. This includes changes to the “One Shot Deal” emergency cash assistance program which helps households who are facing an expense due to an unexpected situation or event, and gives preference to those households with a filed eviction case. The amendment would allow households to receive rental arrears assistance without having an eviction case brought against them.

Tenants and landlords want relief, but take different paths

Advocacy groups for both tenants and landlords want more relief, more immediately.

Tenant and housing advocacy groups such as Housing Justice for All say the complex application process for the current rent relief program is difficult for many tenants looking for immediate relief, and the burden of proof lies on the applicant, said coalition member John August Bridgeford.

Bridgeford said many tenants have reached out with complaints about the application process lacking transparency and being complicated. The Housing Justice for All coalition has demanded full cancelation of rent for all tenants and a hardship fund for landlords to prove their need before receiving public money, and has also called for several bills which would raise taxes on wealthier New Yorkers.

The group has thrown their support instead towards the following three bills: the Housing Access Voucher Program, also introduced by Kavanagh and Cymbrowitz, which would provide housing vouchers for eligible individuals and families who are homeless, or who face an imminent loss of housing. The Housing Trust Fund Corporation would oversee the program, and state and local public housing agencies would administer it.

The two other pieces of legislation were introduced by State Senator Julia Salazar: the first is the Good Cause Eviction bill, which would restrict landlords from evicting a tenant or refusing a lease renewal without showing “good cause.” The second is the COVID-19 Housing Relief and Recovery For All Act, which would cancel rent and mortgage payments for renters and small homeowners for the duration of the crisis.

Landlord groups, meanwhile, are supportive of Kavanagh’s rent relief bill but raised concerns that the federal funding it pulls from will not be available soon enough to restart the economic recovery process. Currently, the Cuomo administration wants to include the federal $1.3 billion in rent relief funds for New York in the upcoming state budget. But the Rent Stabilization Association (RSA), which represents 25,000 landlords, is urging Albany lawmakers to immediately move a state budget bill to provide guidance on the distribution of those federal rent relief funds.

“The Governor must give the legislature a message of necessity, and the legislature must pass an immediate appropriation so that the agencies charged with the distribution of $1.3 billion in federal rent relief can start processing applications and doling out the funds,” said Joseph Strasburg, president of the Rent Stabilization Association. “There is no need to wait for the April 1 state budget to be put in pace. The interests of tenants and landlords are aligned for the benefit of families and our ravaged economy.”

“Everyone wants to avoid the red tape we saw with the $100 million COVID Rent Relief Program – the State is still sitting on $60 million of undistributed funds,” Strasburg added. “They can avoid delays in delivering desperately needed help to millions of struggling New Yorkers so they can pay their rent and landlords can pay their property taxes and repair and maintain their buildings for the safety and comfort of their tenants.”

In December, the state enacted the COVID-19 Emergency Eviction and Foreclosure Prevention Act of 2020, introduced by State Senator Zellnor Myrie, which restricts landlords from evicting New York tenants and property owners who are facing financial hardship during the pandemic until May 1, 2021. In order to qualify, tenants and property owners must submit a hardship declaration to the landlord, the court, or an officer enforcing an eviction (hardship forms for tenants, here and in Spanish here and hardship for landlords here and in Spanish here).

*Editor’s note: This article was edited to clarify there are two separate pieces of rent relief legislation – the Emergency Rent Relief Act (ERRA) and COVID-19 Emergency Rental Assistance Program (CERAP).

9 thoughts on “The Waiting Game for Pandemic Rent Relief in New York”

The gimme-dat generation is making America less competitive in a global economy.

“cancel rent” is the most low resolution policy proposal these housing “advocates” and politicians have come up with yet.

And what about property taxes – how will those be paid? maintenance costs? utility bills? insurance costs (which have skyrocketed)?

Why are property owners the ONLY private citizens being asked to fund COVID related problems? Are grocery stores and restuarants expected to give food for free? Are doctors and insurance companies not being compensated at all? This is crazy.

This is populism at its worst – just making slogans into law without any comprehension or care for the consequences.

I’m still waiting for these legislators to introduce a bill to forego their salary and donate it all to COVID relief.

FACTS! 🙌🏼

I agree with the above comment by Mary completely! My husband and I are mid-70’s and we have always been self-employed, have very small social security benefits, and are non-pensioned people. We depend on the income from our 2 rentals. Unfortunately, the tenants have not been able to pay us since Covid hit. As Mary said, in addition to losing out on the rental income, we still have to pay the utilities, insurance, maintenance, plowing and lawn mowing. This is a terrible strain on us financially, mentally, and emotionally. It just isn’t fair to lay all this burden solely on a landlord and not any other businesses. When are the legislators and other politicians going to stop looking out for themselves and stand up for the “little” guy?? Sign me “Disgusted” with both political parties.

Comment by Mary is Dead On!..

My 3 Tenants have not paid a single penny of rent due since Covid hit. Because of this I owe a year of Electricity, Water, Property Taxes! Luckily I had enough put away for Oil to provide tenants with heat & hot water.

How about this POLITICIANS!? CANCEL ALL CON ED DEBT, ALL D.E P. WATER BILL DEBT, ALL STATE PROP TAXES DEBT, ALL PROP INSURANCE DEBT, ALL MORTGAGE DEBT since covid hit and we landlords will forgive RENT OWED.

I agree with the landlords above. How are landlords supposed to survive if tenants play the game. Tenants are gaming the system and the politicians know it. It is a joke. And they encourage it for votes. Please let the free enterprise system do its job. Pay your rent or get evicted or go on welfare. Let the state pay your rent like it is supposed to. It is just a game for the states not to have to pay rent. And not to to have to hold people accountable for there actions. People are getting money and not paying there rent. They will never want to go to work again the way the government is running things. Stop it. Stop it Stop it. As it is when the courts open, It will be a year before people will get evicted. The judges work at a snails pace and they are not moving for you or me. They are not going to open two or three landlord tenant courts. God forbid.

I was unaware that its my responsibility to provide free rent, water, and trash pickup for 2 of my tenants that haven’t paid in over a year. Open up the eviction courts! I have a buyer for 1 of the rentals, my hands are tied. Good luck to the 2 tenants on finding affordable housing.

Pretty much in the same boat, except it was a unit of my 2 one-family house. Sadly, my tenant stopped paying before COVID even hit. I was in the middle of trying to evict the tenant(s) when the lockdowns, shelter in place, and eviction moratorium happened.

Sadly the man I hired to manage the eviction kept telling me I needed to do the same for the multiple subtenants, which slowed the proceedings to a crawl, as the subtenants understandably refused to give their names.

Now the tenant is still collecting rent from the subtenants, while refusing to pay the rent that they owe.

I can’t wait until August when I can finally resume evicting my delinquent tenant.

This is b s my haven’t paid for 8 month ant I still have to paid morgage property taxes water electricity gas and there is nothing we can do