Center for New York City Neighborhoods, "East New York: Preserving Affordability in the Face of Uncertainty"

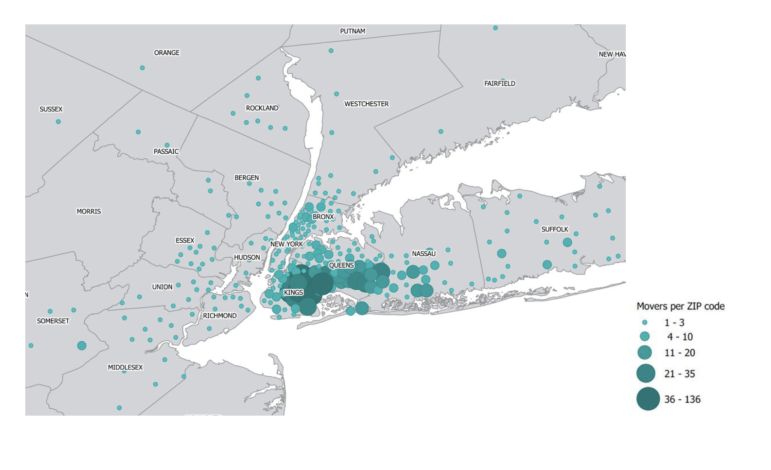

A map from the report showing where East New Yorkers moved if they stayed in the NYC metropolitan area. See below for a map of where others went outside the metro area.

Displacement doesn’t always look like a big-time landlord skirting rent regulation laws. It can also be found where one wouldn’t expect it: among homeowners in a community long known as the last bastion of affordability.

A report released Tuesday by the Center for New York City Neighborhoods, an organization dedicated to affordable homeownership, places a spotlight on the threats faced by low-income homeowners in East New York, where 87 percent of homeowners are Black or Latino.

The numbers are telling. 24% of mortgage borrowers in East New York were 90 days late on mortgage payments in 2014 (with East New York defined to include the neighborhoods of Cypress Hills, Ocean Hill and Brownsville). 63 percent of homeowners reported an “unmet repair need.” East New York homeowners who are already struggling with water and tax debt, wage stagnation, predatory lending and repair problems are also now facing rising property taxes, and the center says the 2016 rezoning of the neighborhood “may spur further price inflation.” That makes homeowners vulnerable both to foreclosure and to selling their homes to scammers and speculators. And it’s not just a problem for those homeowners: it’s a problem for would-be homeowners who can’t afford the rising costs of the neighborhood’s homes, as well as the many others who depend on small homes for affordable rentals.

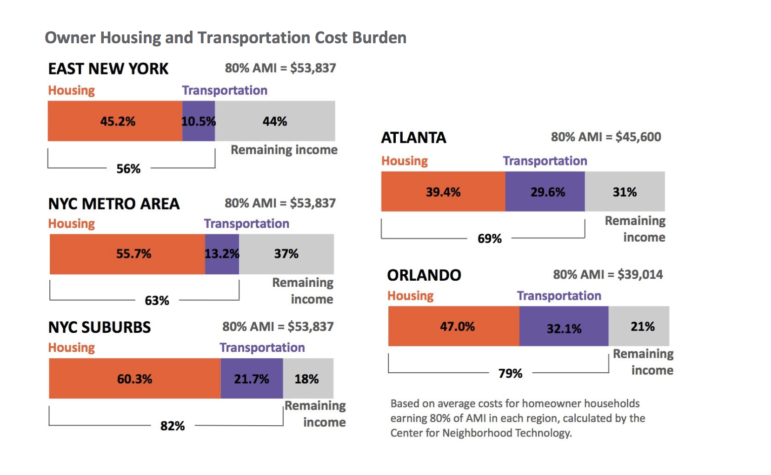

The center also goes a step further, however, tackling an infamously difficult research question: where do displaced homeowners go when they leave? The results show that while there’s truth to the narrative that some families of color are cashing out of East New York and leaving for the suburbs, the story isn’t as rosy for families that leave while in a state of mortgage distress, as they often go places where there are higher transportation costs and, for those who leave the New York City metropolitan area entirely, less opportunities for economic mobility.

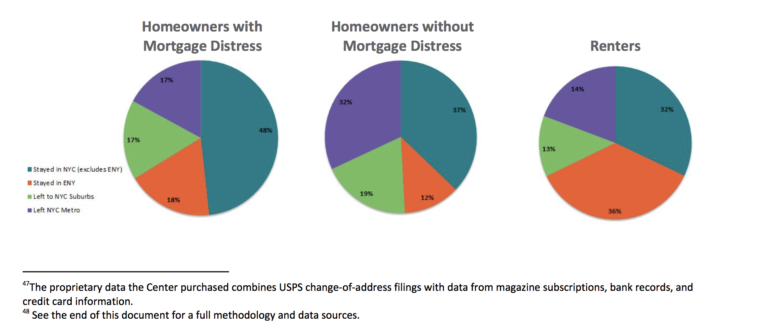

Culling data from its own information about housing-counseling clients, US postal change-of-address forms, and several other sources to determine the pre-move and post-move locations of 2,408 movers between 2012 and 2016, the center studied 1,699 households struggling “with mortgage distress,” 600 “without mortgage distress” and 109 “renters in 1-4 unit homes.” Those figures don’t represent the total number of movers in each category, but simply the movers for which the center was able to acquire complete data—so conclusions can’t be drawn from the report about the reasons why people are most likely to leave East New York.

But the report does provide insight about where movers in each category tend to go. Of the 1,699 homeowners who moved who were struggling with mortgage distress, 67% became renters. Almost half relocated to somewhere else in the city, while 17 percent left to the suburbs and 17 percent left the metro area entirely. The center also found that the majority moved to places where housing was more affordable but transportation costs were greater, offsetting the advantages of cheaper housing. The median income of the movers’ new destinations was higher than the median income in East New York, and new destinations tended to have a higher percentage of white residents—though the movers still settled in predominantly Black and Latino neighborhoods. New Yorkers who left the NYC metropolitan area tended to go places with a lower degree of upward mobility and a greater physical distance from jobs.

Homeowners without mortgage distress tended to end up in areas with “somewhat stronger economic conditions” and were more likely to leave the five boroughs. Renters more often stayed in East New York than homeowners, and if they moved elsewhere, they tended to go to areas more similar to East New York.

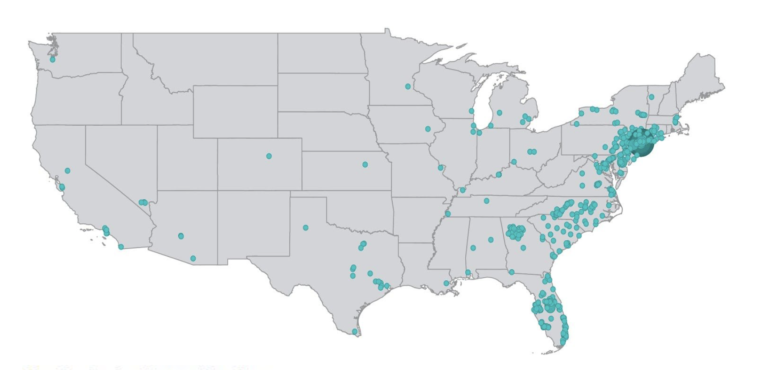

In addition, the center found that, considering all three types of movers, after the New York metropolitan area (including New Jersey, Connecticut and Pennsylvania), suburbs in the Atlanta metro area and Orlando metro area drew the most movers.

From this data, the center makes a few conclusions: that East New York homeowners who are mortgage distressed are contributing to the swell of renters entering lower-cost neighborhoods like East Flatbush, that movers continue to experience racial segregation in housing after leaving East New York, and that there are sometimes downsides to the suburbs to which homeowners in distress move.

“Suburbs promise more space and cheaper living. However, they are often far from jobs and have uncertain economic futures as more and more high-paying jobs concentrate in just a few cities across the country,” the report says.

Ultimately the report recommends the implementation of a variety of programs and reforms to protect stressed homeowners and their tenants, including initiatives that advocates have been demanding for years—things like a tax on house flipping, protection for low-income homeowners from the tax lien sale, and programs to help small landlords keep their rents affordable for tenants.

Here are some other diagrams and maps from the report:

Center for NYC Neighborhoods

Nationwide destinations for East New York movers.

Center for New York City Neighborhoods

A diagram breaking down where East New Yorkers moved to.

Center for New York City Neighborhoods

A diagram showing differences in average costs for the regions where East New Yorkers move.

6 thoughts on “Displaced to Where? New Report Shows Moving Patterns of Some East New York Homeowners”

Interesting story. Having lived in ENY/Brownsville before and during the White flight/block busting era am I witnessing a reversal? Will there really be gentrification? How many naive, but well-monied millennials will be induced to believing this area is the next hot neighborhood? Where will they send their kids to school? How soon before these pioneers move out after realizing they are fresh prey for the criminal element that still dominates the area?

ENY still has serious problems but in NYC’s crazy real estate market nothing surprises me. So you were around when ENY went from a nice Italian/Jewish neighborhood to a dangerous slum in just a few short years.

Pingback: Displaced to Where? New Report Shows Moving Patterns of Some East New York Homeowners (City Limits) - Center for New York City Neighborhoods

Pingback: Displaced to Where? New Report Shows Moving Patterns of Some East New York Homeowners (City Limits) - Center for New York City Neighborhoods

Thanks for the informative piece about the neighborhood where I grew up. My German/Dutch immigrant parents scraped together their pennies to buy a small building with commercial space on the first floor, 2 apartments above. This was the mid 1940’s. We had a backyard, but I preferred playing in the streets and in our local park, and I walked to school and the library. By the mid-50’s my parents had separated, the ice cream parlor closed– in part because of gang activity and vandals slashing the beautiful red leather upholstery in the booths. My single mom and I fled to a rental apartment a few blocks into Cypress Hills. The building, which my parents bought for $15,000 in the 1940’s, was sold for $7,000 in the 1970’s. If only it had stayed in the family!

There are always people lurking around to take advantage of a situation. I don’t care what level you’re on. Scum will always prey on the weak.

What people have to do is always think in groups. Never operate as an individual. You are stronger in numbers. That’s why if there is a community of a particular ethnic group and you belong to that group you must always think about preserving that group. There is such value to that community.

We as a people…Black people…must think outside the box.