CITY VIEWS: OPINIONS and ANALYSIS

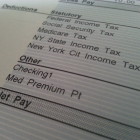

Opinion: Raising Taxes on NY’s Wealthy is the Right—and Popular—Thing to Do

Leslie McCall |

“Not only are such increases necessary to secure investments in badly needed and widely desired public goods like education, health care, and housing, the costs of which are likely the driving factor behind the worrisome out-migration of working and middle class New Yorkers.”