In a Manhattan neighborhood where utilitarian stores have transformed into trendy eateries, meatpacking businesses were made over as designer dress showplaces, and every other storefront becomes an expensive hair salon, a string of old-school, regular-Joe shops is taking a contrarian stand against rising rents and business displacement.

Along Ninth Avenue where Chelsea meets the Meatpacking District, owners of such businesses as Sweet Banana Candy Store, 9th Ave Gift Shop and Chelsea Liquors, along with their patrons, activist allies and local officials, are pushing back against seemingly inexorable trends. Back in November, Morris Moinian’s Fortuna Realty Group bought the building, which is home to these stores as well as a dry cleaners, Chinese takeout, barbershop and check cashing office, for $31.4 million. Now, Fortuna plans to renovate the strip and try to attract higher-end tenants; it has already told Brian Rhee, who’s owned Chelsea Liquors for 34 years, that he has to vacate by the end of August.

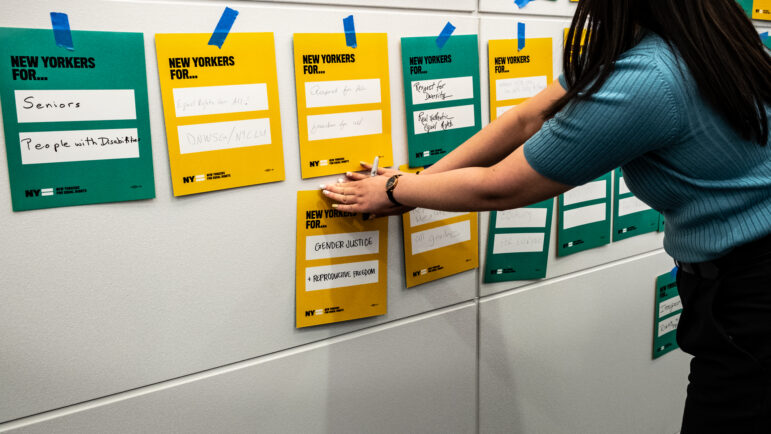

At the liquor store, on the shelf behind the register next to the Johnnie Walker Red is a photo of a rally held on the sidewalk out front in early May. In the photo, people display handmade signs reading “Save Our Shops.” In addition to trying to hold on to community mainstays, however, some of these agitators are looking more broadly at what can be done to retain the familiar in similar situations citywide.

From tailored zoning regulations to special tax arrangements to bringing back an idea from the 1980s of “commercial rent control,” land use analysts are examining the options. State Assemblyman Richard Gottfried, who represents the area, is one who’s interested in the potential of commercial rent control. “Just as residential rents can drive people out of the community if they’re not protected by rent stabilization, the same can happen with commercial tenants,” says Gottfried. “A neighborhood can have whole blocks or avenues of stores wiped out in a very short period of time as these come due, because landlords can refuse to renew a lease or insist on any rent they can get without limitation. Without some kind of rent law in place, a landlord needs no excuse for throwing residential or commercial tenants out on the street.”

Sung Soo Kim, founder and president of the Small Business Congress of New York City, a federation of 70 trade organizations, agrees that when it comes to disappearing businesses – whether Coliseum Books or CBGB’s – “Rent is the major issue.” Kim says the city averaged 6,000 commercial evictions per year under Mayor David Dinkins; this number jumped to 7,500 per year while Rudy Giuliani was in office, and has soared to more than 10,000 per year under Bloomberg. In 2006, Kim cites data that there were more than 14,000 commercial evictions in the city. While these figures are for commercial evictions, a broader category than small businesses, he’s convinced that the vast majority of the casualties are small businesses.

Moinian, the new owner of the building containing 114 through 124 Ninth Avenue, feels he’s been demonized for doing normal real estate business. “I still don’t get the fuss about someone paying $2,000 after 20, 30 years,” he said of Rhee (who pays $2,400 per month for 850 square feet), when the going rate for an attractive commercial location like that would be more like $6,000 or $8,000 per month. “As a developer, you try to renovate, you try to create value, then you move on,” he said.

Moinian says he has not been contacted by elected officials about the situation, and is unaware of any proposals for saving small businesses. “I don’t know if that can ever work in a democratic society. It’s really above and beyond me,” he said. “It’s not just one store – it’s an issue at large for the country.”

~

Some residents of the Robert Fulton Houses, a public housing complex directly across Ninth Avenue from the stores, wonder where they’ll shop once the pricier new tenants arrive. “As you see small businesses being displaced in the community,” says Miguel Acevedo, a member of local Community Board 4 who helped organize the May rally, “you really start to think – even if you live in public housing, you may not be able to afford to live here.” Acevedo leads a group called Fulton Youth of the Future, which works with the more than 2,000 residents of the Fulton Houses. “The scary part is that they tell you they don’t have a place to shop; where do we go to now?”

New York City actually enjoyed commercial rent control as part of the price controls introduced during World War II, and the statute stayed in force until 1963 – though the breadth and depth of its impact are unclear. More recently, former Manhattan borough president Ruth Messinger waged a bitter struggle through much of her tenure on the City Council in the 1980s to pass such a bill.

“‘Commercial rent protection,’ we called it,” recalls Councilwoman Gail Brewer, who now represents the Upper West Side but was Messinger’s chief of staff at the time. (Messinger was traveling abroad and unavailable for comment.) The proposal applied to businesses that occupied fewer than 10,000 square feet, for which it limited rent increases to 45 percent over five years. If tenants and landlords were unable to agree on a new lease within those limits, they would then have been required to enter binding arbitration.

“We definitely need to address this issue,” Brewer says today. “It destroys neighborhoods; it destroys families.” She is focused on the wave of drugstores and banks that have been replacing small, local retail outlets in her district. While some argue that there is little difference between chains (sometimes referred to as formula businesses, given the generic models on which they’re constructed) and local retailers, a growing body of research contradicts such arguments.

When Borders chain bookstore threatened to open a new store in the heart of downtown Austin, Texas, a local consulting firm called Civic Economics produced a study (commissioned by the Austin Independent Business Alliance and another organization called Livable City) that found that for every $100 in sales, Austin’s local businesses were pumping $30 back into the city. In contrast, only $9 of every $100 spent at a proposed Borders would be spent in Austin. A similar study of a Northside Chicago neighborhood by the same firm found that “for every one hundred dollars in sales, the locals generate sixty-eight dollars worth of local economic activity and the chains just forty-three dollars.”

“I’m not saying get rid of all the big stores,” says Brewer, “but the fact of the matter is the balance is tipped the wrong way.” She goes on to say: “When I speak to actual shopkeepers, they are adamant that the best way to solve this would be to give the owner [of the building] a break.”

Vicki Weiner, director of planning and preservation at the Pratt Center for Community Development, is also exploring the idea of a tax abatement for property owners linked to a voluntary rent cap. Weiner suggests a more traditional approach could simply cap rent at some percentage of a retailer’s gross annual sales – which poses risks to landlords, because if a store is unsuccessful the landlord will receive less rent – or by setting rents at roughly 60 percent of the fair-market value of the commercial space in a given community district or census tract. However, Weiner is quick to emphasize that, “I’m sure we’re dealing with a situation where saying across the board there should be commercial rent control is unwise.”

The question is to how to target protections to save small businesses. Research by the Pratt Center suggests that given the current role of chain stores in forcing out small businesses, zoning regulations focused on particular neighborhoods may be one promising way of meeting this challenge. A measure as conceptually simple as store size caps can inoculate a neighborhood from chain stores, reducing the pressure on rents. The Pratt Center points to three cities that have adopted such caps in particular neighborhoods, and another 27 that have adopted citywide size caps.

Other potential zoning tools include community impact reviews, under which new commercial developments, or developments above a certain size, are subject to a comprehensive review before they can open for business. Brattleboro, Vermont has amended its zoning code to require a community review of any retail project that will eat up more than 65,000 square feet. Establishing “neighborhood serving zones” is another tactic: In Palm Beach, Florida, stores over 2,000 square feet require a permit, and the applicant must demonstrate the store is “for townspeople.” Finally, San Francisco has gone so far as to simply ban chains in two neighborhoods and require public review of any new “formula business” that would open in the city.

Of course, formula businesses are by no means the only driver of gentrification; in this part of Chelsea, actually, small stores are mostly being replaced by other small stores –just aimed at a wealthier clientele. This is why Weiner declares, “One tool is not enough. …There’s a place for land-use regulations, and there’s a place for some sort of rent cap … It calls for serious planning.”

~

Julia Vitullo-Martin, director of the Center for Rethinking Development at the Manhattan Institute, rejects all of these approaches. The best fix for rising rents would be to increase the supply of land by “eliminating artificial restrictions,” including zoning, and encouraging property owners with street frontage to rent it. Vitullo-Martin points, for example, to the opportunity provided by the Fulton Houses across the avenue, a New York City Housing Authority complex.

“Of its 343 developments, NYCHA offers commercial leases in only 28,” she wrote in an e-mail. “What an amazing and destructive restriction on the supply of land – not only could NYCHA reap revenues from good retail, its tenants would benefit from having the services they need – grocery store, pharmacy, bank, dry cleaner, etc.”

“And it’s not just NYCHA shunning retail leases – but most of the nonprofit world,” she writes. “When a social service or nonprofit agency takes over a commercial building, as has been happening on Broadway on the West Side, it shuts down all retail – bad for the neighborhood, bad for street life, and restricting supply.”

For now, it looks like one of the last redoubts of the old neighborhood is at risk. On a recent Friday afternoon, a few older men lounge on folding chairs that Chelsea Liquors owner Rhee keeps in his store for them.

“They sit over there talking, talking,” Rhee says, “but their eyes are all over the place. They’ve lived here 30, 40 years; they know everybody.” The relationships that small businesses sustain are hard to quantify, but no less important.

The shop owners “know exactly how we like our coffee,” says Acevedo. “What newspaper we read. If one of our kids is diabetic, they know what to sell them.” All this is at risk. “It’s just a family feeling that we have with these small businesses, and we don’t want to lose that either.”

Nor does Brian Rhee want to lose his store. “I’m 68 years old, my daughter is in school, I want to retire,” he says. “This is my life.”