‘The lower the trading volume, the lower the tax. This would help diminish the wild and speculative volatility that caused many of Wall Street’s and America’s problems in recent years.’

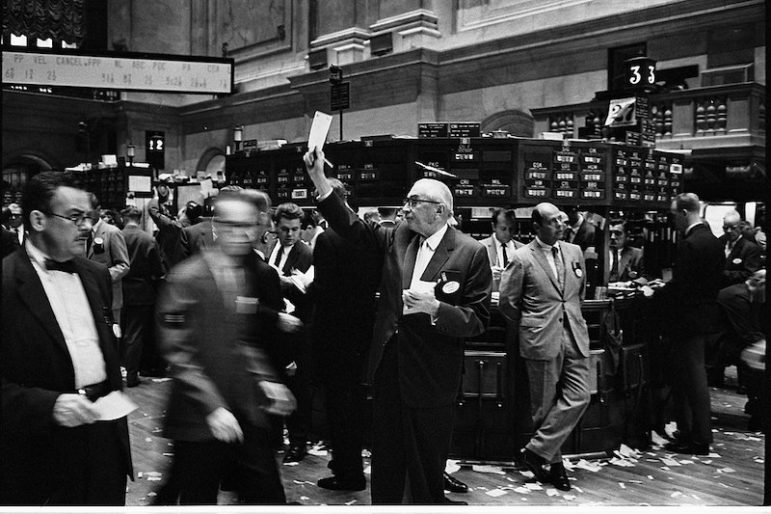

Thomas J. O’Halloran

The floor of the New York Stock Exchange in 1963Without any federal aid, New York State will face austerity for the next four years or more. Governor Cuomo and some Albany legislators have suggested cutting all public spending by 20% as a solution. That means solving austerity by imposing more austerity!

The solution, however, lies in our own hands: It is the Stock Transfer Tax. This small excise tax on stock trades amounts to pennies per share to be paid by investors. It generated roughly $15 billion in 2010. And as stock market activity improves (post-Covid19), it is likely to generate many more billions in years to come

The New York Stock Transfer Tax has been law since 1905, but since 1981, the money that is collected has been rebated 100 percent to the investors who pay it. Anytime within two years after payment, the investor fills out a return form (MT-650), submits it to the state, and the state immediately credits the money back to the investor. Now, Assembly Bill A7791 would end the rebate, automatically crediting billions of dollars to the state’s general fund for the benefit of all New Yorkers. The tax is up to 5 cents per share, for a stock sale at $20 or more per share. Its impact is mostly on frequent moves of large blocks of stock, the sort that Wall Street speculators commonly engage in.

In order to prevent or oppose Wall Street speculation, the underlying stock transfer tax rate should be linked to a person’s trading volume: The lower the trading volume, the lower the tax. This would help diminish the wild and speculative volatility that caused many of Wall Street’s and America’s problems in recent years.

Some Albany legislators want to wait and see if Washington comes through with aid to our state before they do anything about collecting the Stock Transfer Tax. Yet, waiting for federal aid has already left us all dangling in the wind. And many New York State residents are now faced with eviction, foreclosure, homelessness, poor quality health care or none at all, and/or food insecurity because of no federal aid to New York.

CityViews are readers’ opinions, not those of City Limits. Add your voice today!

CityViews are readers’ opinions, not those of City Limits. Add your voice today!

Other legislators are fearful that collecting this tax will cause businesses to flee our state, workers’ 401K’s to lose money, and the New York Stock Exchange to leave Manhattan. New York adopted this tax in 1905, (New York Tax Law § 270.1), despite threats from the New York Stock Exchange that it would then immediately move to New Jersey. And in all this time the Stock Exchange has never left New York. The London Stock Exchange collects a significant stock transfer tax—and, regardless, continues to flourish mightily. Germany, Switzerland, Hong Kong, Singapore and France also have stock transfer taxes. It cannot seriously be claimed that if New York collected the stock transfer tax, that the New York Stock Exchange, AMEX and NASDAQ would all flee into cyberspace. After all, stocks are already traded electronically, and New York is increasingly effective in collecting state taxes on online purchases made out-of-state.

The pandemic plus the recession have already destroyed one out of six small businesses. Given the business climate around the country, its doubtful that businesses would flee New York State. Since workers’ 401K accounts do not involve wild and frequent casino-like speculation on Wall Street, there is no reason to claim that the Stock Transfer Tax would cause them to lose money. Ending the rebate and placing the Stock Transfer Tax in the State’s general fund for the benefit of all New Yorkers would strengthen faith in the social contract between our government and the people of New York. Equally important, it would demonstrate to the entire country that New York State elected officials act with integrity, and are courageously willing to prevent the losses that the Trump administration and Republican-dominated Senate wish, increasingly, to visit on our fair state.

Mary Ann Castle, Ph.D., is a senior associate at Planning Alternatives for Change. Gene Grabiner, Ph.D., is a SUNY Distinguished Service Professor Emeritus.

2 thoughts on “Opinion: Now More Than Ever, NYC Needs a Stock-Transfer Tax”

The NYSE trading floor is just a backdrop for cable TV. The NYSE is more mobile than at any time in the past. They can leave New York virtually overnight and I’m sure even the dense Phil Murphy would pick them up for NJ in a minute.

Why not a 105% tax on all trades plus a 105% tax on all gains.