Luz García’s life was already tough enough last year. The 44-year-old was sick. She suffered not just chronic asthma and heart trouble, but had just had an operation to repair narrowed vocal cords, which left her breathing through a tube in her throat with the help of an oxygen machine.

The condition of her decrepit apartment–one of three in a building at 74A Fourth Avenue, near where Park Slope and Boerum Hill come together–just made matters worse. “Often we had no hot water,” she remembers. “There were rats and fleas everywhere.”

García’s landlord didn’t just neglect his tenants; he also failed to pay his taxes. City records show that Ismael Latorre bought 74A Fourth Avenue in 1989, and that by 1998 he was no longer paying his property taxes or water and sewer bills. So the city, as part of the Giuliani administration’s new tax collection strategy, sold the property’s tax lien–its $21,446 debt–to an investment trust, which in turn hired a collection agency. But Latorre still wouldn’t pay. Following its contract with the city, the collection agency, JER Revenue Services, moved to seize the building, sell it at auction and recoup the debt.

According to the architects of the new collection policy–the common shorthand is “tax lien sales”–García’s living situation should have improved after the sale. The old landlord would be replaced by a new one, who would invest in the property and make life better for tenants.

But that’s not quite what happened. Someone did step forward in July 2000 and pay JER what was due: Robert Hernández, who bought the property directly from Latorre. The new owner set out to make his investment back. But to do it, he planned to evict the current tenants, the first step toward rehabilitating the building and charging high enough rents to make the purchase pay off.

“He told me I couldn’t stay there,” García remembers. “But I had nowhere else to go.”

García brought her case to the Fifth Avenue Committee, a community group in her rapidly gentrifying neighborhood, which fights to preserve affordable housing for longtime residents like García. Benjamin Dulchin, the committee’s director of organizing, knew the law was on Hernández’ side–García had no legal lease and the building wasn’t rent-stabilized, which meant that the landlord could evict her just because he wanted to.

Dulchin was able to negotiate several months of time for García to stay. But Hernández continued to neglect the building’s repairs. He did tell García he’d be happy to keep her on as a tenant–if she would pay $1,250 a month. But a $500 increase was more than her disability check could cover. By December, the situation was dire. Space heaters provided the only warmth, and one freezing night, water pipes froze and burst, causing the electricity to go out. García’s breathing machine shut down.

Dulchin convinced the city to make emergency repairs to get the electricity back on. They did, but after breathing for several days without the machine, García developed a lung infection. She cries today remembering how scared she felt. “I began to bleed out of my mouth and nose. We called an ambulance right away. They told me in one more hour, I would have been dead.” After a trip to the hospital, García ended up spending six months in a nursing home. While she was laid up in her hospital bed, Hernandez threw her few remaining belongings into the trash. He had finally gotten her out.

Living today with her daughter in Sunset Park, García remains furious at the landlord whose neglect almost killed her. “He didn’t care. But I couldn’t defend myself, not with my health,” says the 44-year-old, crying so hard her voice is barely audible. (Neither Hernández nor Latorre could be reached for comment.)

For Dulchin, García’s case shows how the tax lien sales program fails to protect tenants from unscrupulous landlords intent on buying dilapidated properties and evicting their occupants. “For years that building was in absolute limbo, and the tenants got slammed,” he says angrily. “That’s when the city should step in and help these tenants. Instead they wanted to get their debt back.”

_______

For the officials who run tax lien sales, the sale of 74A Fourth Avenue produced the desired outcome. “Our only interest is that the lien gets paid,” says Peter Lempin, a deputy commissioner in the Department of Finance who manages the tax lien sales program.

That article of faith–that any program that increases the city’s tax collection rates must be good policy–has driven the tax lien sales plan since the first debt was sold in 1996. By those measures, it has been an extraordinarily successful program. In the first eight rounds of tax lien sales, from 1996 through 2001, the city pocketed more than $895 million in uncollected taxes and fees. The city has also seen its rate of delinquency plummet: In 2001, only 2.81 percent of property taxpayers failed to pay their bills on time, the lowest percentage ever. (In 1989, the delinquency rate stood at 5.7 percent.) That increase in tax collection rates is significant; just a 1 percent hike puts about $80 million more in the city coffers.

But the problem is that while tax lien sales may work as fiscal policy, it’s also a housing policy–one that affects tenants, like García, who just scrape by in the city’s most perilous properties. Numerous studies have shown that buildings owing back taxes almost always need repairs. Do these tenants see their buildings improve when their current owner pays off the lien? What if a new owner buys the building? How about those properties that are auctioned? Has the program increased, or decreased, the city’s affordable housing stock? Important questions, especially for a program that involves more properties and dollars than any other of its kind.

Yet these are questions no one has seriously tried to answer. Housing advocates and the City Council have taken a look, but they’ve found that the data is incomplete. JER keeps meticulous financial records, so it can tell you when the lien was paid off–but that’s essentially all the information it has on the 31,000 liens it’s sold since 1996, not just on homes and apartment buildings but scores of gas stations, warehouses and vacant lots. (The total number of properties with liens sold is likely around 25,000, as some properties have liens sold more than once.)

Says one city official who has watched the program closely: “Once the liens are sold, it’s a mystery.”

_______

The practice of seizing property from owners who don’t pay taxes has been around nearly as long as taxes themselves. It wasn’t until the 1970s, when white flight, arson, joblessness and disinvestment in poor neighborhoods led landlords to abandon thousands of properties, however, that New York City began to routinely take possession of buildings. Many of the tenants who had remained simply couldn’t pay their rents, so building owners couldn’t pay their mortgages or taxes. During the mid 1970s, the city took as many as 10,000 properties a year from landlords who had just walked away. By 1986, the city was a huge landlord, managing 39,551 units in 3,944 properties.

It was an extraordinarily expensive undertaking. Managing and maintaining residential properties cost an average of $2.2 million per building, a 1995 audit showed. But the policy also had benefits, especially for tens of thousands of city residents who might otherwise have been homeless. “At least there was a public commitment to not losing properties,” says Legal Services attorney Dave Robinson, an expert in city policies on dilapidated housing. The city-owned real estate also became the housing stock for programs that have transferred thousands of properties to new owners–nonprofit organizations, tenant groups and private landlords–who maintained affordable housing in vulnerable neighborhoods.

Mayor Rudy Giuliani won his job by attacking wasteful city spending, and the city’s role as landlord extraordinaire was one of his main targets. On Halloween 1995, Giuliani unveiled his long-awaited housing plan that he promised would both improve neighborhoods and save money. Tax lien sales would provide immediate cash for the city. The city Department of Housing Preservation and Development would establish an “early warning system” to identify buildings before they went bankrupt, and the city would offer these landlords technical assistance and low-interest loans to help them get back on their feet. The city would hand over the worst buildings to screened private landlords or community-based nonprofits–a proposal dubbed “third party transfer.”

Fiscally, the city’s embrace of tax lien sales made perfect sense. In an instant, the city could trade outstanding debt that might take years to collect for an immediate infusion of cash. New York City wasn’t the first place to try bulk lien sales–Jersey City and New Haven took the plunge first. But New York’s was–and still is–by far the biggest lien sale program ever.

Housing advocates and community groups in poor neighborhoods worried that tax lien sales would throw vulnerable housing to the whims of the market with no protections for tenants and homeowners. But the Giuliani administration assured them that inhabited properties would be largely excluded from the program–the liens to be sold would mostly come from vacant lots and abandoned commercial properties like warehouses and gas stations. “We didn’t have an objection to the lien sales when they were being advertised as primarily a collection mechanism for commercial property delinquencies,” recalls housing expert Frank Braconi, executive director of the Citizens Housing and Planning Council.

To make sure that housing interests weren’t ignored, City Council members, led by Manhattan Democrat C. Virginia Fields, modified the mayor’s plan. Their amendments prohibited the city from selling liens on certain properties–low-income housing developments, tenant cooperatives, and other vulnerable residential properties that the city Department of Housing Preservation and Development deemed “distressed.” Observers say the council was particularly interested in protecting such buildings after a March 1995 building collapse in Harlem that killed three tenants. The 140th Street property owed $96,000 in back taxes, bolstering the argument that tax debt was a signal that a building needs immediate help.

The early-warning, landlord assistance and third party transfer programs seemed like good alternatives for troubled properties, but housing advocates did wonder if the Giuliani administration would devote the resources necessary to make those programs work. A skeptical–and prescient–note was sounded by the president of the Parodneck Foundation, affordable housing developer Harry DeRienzo, who wrote in 1995 that the city has “no intention of dealing with the troubling realities of the distressed market and only intends to develop a program that sounds good on the surface.”

In fact, a plan that was sold as everything but a housing program has become one–more than 8,000 liens on residential properties have been sold since 1996.

Joseph Robert has spent hours lobbying Fidel Castro over mojitos in Havana. He met with guerrilla leaders in the Colombian jungle and solicited the president of Indonesia, seeking to convince the leaders of wayward trouble spots to embrace the gospel of the free market. Robert, who founded the J.E. Robert Companies in 1981, trumpets his own success story when he preaches the virtues of capitalism in these high-profile global adventures.

J.E. Robert Companies has profited from the ashes of dying companies. Robert built a personal fortune by buying and selling loans, real estate and other assets from failed institutions, like banks and savings and loans. Such ignoble work has been immensely successful–the company has managed more than $35 billion in assets in the past 20 years.

It was a logical step to move from managing the troubled assets of failed banks to contracting with governments to collect stubborn tax debt. The company’s governmental division–JER Revenue Services–first began working with municipalities in 1984.

JER, with 45 staff working on their New York City account in an office park just north of New Haven, say they are a modern alternative to outmoded municipal tax collecting. They say their expertise in getting the maximum dollar for troubled properties, along with their sophisticated computing systems and persistent staff, allow them to accurately and efficiently service both delinquent taxpayers and the city. Those arguments have evidently been backed up by solid performance: JER was one of several companies that handled New York City’s initial tax lien sales collections, but today it’s the only one.

The city and JER have run eight tax lien sales since 1996. At least two months before a scheduled lien sale, the city puts together a list of all properties with outstanding debt: at least three years’ worth for private homes and co-ops or condos; just one year for multifamily buildings and commercial and vacant properties. Tax liens aren’t just unpaid property taxes; the city also includes outstanding water and sewer charges, environmental and health bills for costs like cleaning up trash, and money owed HPD for emergency repairs performed by the city.

Property owners can pay their debt to the city at any time before the actual lien sale–and thousands do, spurred by the fear they will soon be facing tougher debt collection tactics. The city then pools all the unpaid liens–thousands at a time–and sells the debt to a private trust at a discount, assuming that some of the liens won’t be fully collected. The trust’s investors don’t actually buy the liens themselves. They buy bonds, which will be paid back with interest as the liens are recovered. The trust then uses the bond proceeds to pay the city.

As soon as the liens are sold, JER enters the picture. “Our whole effort is to create urgency, to make them realize we’re serious,” says JER’s managing director John Chilson. Their main strategy is to politely but firmly assure the debtor, by phone and mail, that they’ll lose their property if they don’t pay up. The interest on the liens, which helps pay the bondholders, also grows immediately, at 18 percent compounded daily, the same rate the city charges on tax debts. JER is paid by a 5 percent surcharge that is added as soon as the lien is sold.

All this couldn’t be more different from the kinds of efforts the city previously made to collect unpaid cash from property owners. From 1993 to 1996, the city didn’t seize any buildings at all, on the premise that it was more cost-effective to let overdue bills pile up than to take on the great expense of owning and managing still more buildings.

JER first tries to convince owners to at least pay the first six months of interest on the lien. If there is no payment or effort to set up an installment plan in the first six months, the foreclosure process begins.

“We’re pretty flexible,” Chilson says of the company’s collection strategies. “We’d rather not initiate a foreclosure process” for the simple reason that the sooner the bondholders get paid back, the better. An auction can pay back the tax debt, but only after a costly process that can last as long as two years. On the other hand, a check from the owner (or a new owner) comes immediately. That helps explain why JER has supervised auctions for only 727 properties–86 of which have been residential–since 1996.

Auctions are good for New York City neighborhoods, according to JER. During a July interview at their Connecticut corporate park office, company officials proudly showed before-and-after photographs for several auctioned properties. One photo they exhibited was of 261-271 Kosciusko Street in Bedford-Stuyvesant. The first photo showed a boarded-up, uninhabited apartment building. The later image included new windows and a dumpster filled with construction debris, suggesting the new owner was improving their property.

But a closer look at the Kosciusko property tells a different story–one that JER shouldn’t be proud of. A developer named Select Holding Corporation bought the property at auction in March 1999 for $147,000, and split what was an 18-unit apartment building in half, into two separate properties, each with four apartments. Select Holding fixed up the building–repairing broken windows, carpeting floors and installing new appliances–and re-sold it. Unfortunately for the buyer, these improvements covered up some serious flaws.

“I didn’t even know it was sold at auction,” says Robert Philip, a 42-year-old accountant who, along with a partner, bought one of the buildings for $411,000 in December 2000. “That helps explains this mess.”

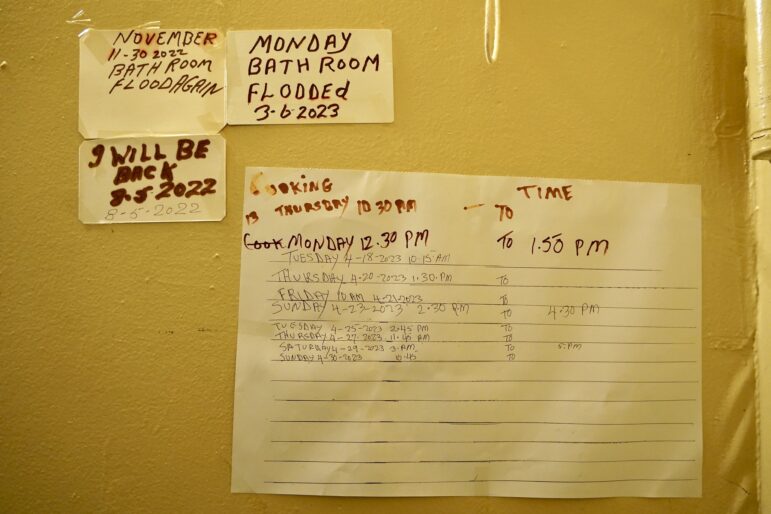

Philip’s mess has grown steadily since he rented three apartments and moved into his own unit. He wearily recites the problems he and the other tenants have had. Inadequate plumbing and drainage problems wasted water and regularly flooded the basement. The toilets used to flush hot water. There are holes in the roof. Poorly patched exterior bricks are cracking. Worst of all, the contractors didn’t put insulation in the buildings’ walls. “They just did it for a quick buck and they were very sloppy about it,” Philip says bitterly.

Philip has been able to convince Select Holding to pay for some repairs, but he says they’ve been resistant about others, so he’s also considering suing them. (Select Holding wouldn’t return phone calls seeking comment.)

JER recognizes that the tax lien sales could be compromised by negative publicity if properties are handed off to unscrupulous owners. So in 1998, JER set a “buyer’s qualification” policy: Private buyers of property have to sign an affidavit swearing that they don’t owe the city $20,000 in back taxes and don’t have an unpaid bill with the city for emergency repairs. But these criteria apply only to the few buildings that the company isn’t successful at auctioning–meaning they can’t meet the legal requirement of fetching a price that will cover the property’s debt–and that it ends up selling privately.

And no one checks to make sure the buyer is being truthful. “I assume the city does an audit later,” said JER manager Peter Fester. They don’t. “We’re out of the loop on that one,” says Deputy Commissioner Lempin. “All they do is make us aware of the affidavit.”

_______

Tax lien auctions are by definition speculative–a prospective buyer can research the building’s financial history, but can’t legally enter the property for inspection. That’s one reason why tenant advocates were so worried that widespread tax lien auctions would lead to unwise investments. There’s nothing to prevent the highest bidder from overpaying, borrowing too much money and quickly falling behind on their mortgage and taxes, fueling abandonment of vulnerable properties. It hasn’t happened, but many wonder if that will change if the city’s housing market turns down.

“Some of us remember when in 1988 and 1989, so many properties foreclosed,” says real estate attorney Steven E. Resnick, who represents landlords. “It will be very interesting to see what happens in a declining market. Will JE Roberts foreclose? Will the trust decline to foreclose, and just eat whatever they’re owed?”

(JER recognizes that a housing recession would complicate tax lien sales. The company says that if auctions don’t fetch sufficient prices, they’ll have to expand their marketing efforts and become a realtor–advertising heavily and reaching out to owners of adjacent buildings. “There’ll be a time when we’ll end up with a core of properties, and we’ll have to do something more creative,” says Chilson.)

Using photographs to evaluate tax lien sales may seem strange, but other than looking at the fiscal success, it’s all anyone has tried. That’s in part because so little useful data exists. JER does send the Department of Finance and the City Council reports on what happens to individual buildings. But these reports only note whether the lien was paid, is in collection or if the property was sold at auction. There’s no mention of whether code violations decrease, if rents change or whether the lot of tenants improves.

Housing experts have realized that tax lien sales are affecting thousands of properties in low-income neighborhoods. They’ve tried to analyze the only data available–JER’s reports–but they’ve been frustrated. “I found it really difficult to cope with their reporting documents, because they are only interested in the collection,” says Celia Irvine, a housing policy analyst (and City Limits board member) who tried to do a comprehensive tax lien sales survey when she worked for the Association for Neighborhood and Housing Development. “We’ve tried a couple of times, but it’s a pain in the butt,” adds Jim Buckley, executive director of University Neighborhood Housing Program in the Bronx.

What may be most frustrating is that the JER reports don’t even say whether the payer of the lien was the old owner or a new owner–a critical piece of information needed to evaluate whether the program fuels speculation. “There’s no reason for us to track [who pays back the lien],” says Barbara Epler, a JER vice president.

_______

Essential to generating support for tax lien sales was the city’s early warning system proposal, a database that would track complaints about broken boilers, fines for piling garbage, and missing tax payments and let HPD know when a given building was in trouble and needed help.

HPD worked with University of Pennsylvania researchers and Michael Schill, the director of NYU Law School’s Center for Real Estate and Social Policy, to develop an effective system that the public would also be able to access. But after a change in HPD leadership–Commissioner Deborah Wright left in April 1996 and was replaced by Lilliam Barrios-Paoli–the project languished, was never fully developed and has never been made publicly accessible.

Instead, HPD first removes buildings from the tax lien sales list that it deems “distressed.” In those cases, the debt is not sold, JER doesn’t enter the picture and foreclosure doesn’t proceed–landlords simply get to hang on to their buildings, and, according to HPD, the city helps them improve the property’s physical and financial conditions.

Following the City Council’s definition, a residential property is considered distressed if it has a total tax lien debt that is equal to more than 15 percent of a building’s value. So a property valued at $100,000 would fall into the distressed category if its lien debt were at least $15,000. In addition, the building must have either an average of five immediately hazardous violations of housing codes per apartment, or be subject to an HPD lien for emergency repairs.

Through the Neighborhood Preservation Consultant Program, HPD also pays neighborhood groups to pore over the tax lien sales list, identifying which properties in their communities are distressed. Some NPCP groups, like the Pratt Area Community Council in Fort Greene and Bedford-Stuyvesant, also use computer databases to look at mortgage records and see which buildings have serious financial problems. The inspections do have significant limitations–the groups don’t have any legal right to enter the properties, for example.

Through both of these routes, as well as based on its own criteria, HPD has pulled out up to 18,000 properties with tax liens, excluding them from the sales. (Some are pulled more than once; HPD couldn’t say exactly how many.) The numbers show that HPD has excluded fewer properties in recent years–particularly in 2001, when liens on about 3,500 residential properties were sold. The increasing demand for properties, even in poor neighborhoods, does suggest that the marketplace can take care of even troubled buildings, as long as there are tenants willing and able to pay high enough rents.

HPD spokesperson Carol Abrams says that city staff has learned over time that fewer build ings require special care than they had at first anticipated. “We’re increasing our experience with site inspections. Earlier in the process, we would have excluded more so than we would today.”

What happens next may be the most critical piece of the city’s tax lien sales strategy. What to do for these vulnerable properties? The city agrees with advocates that some buildings are so screwed up–riddled with debt and requiring massive repairs–that they require public subsidies in order to ward off abandonment. In a written reply, HPD says it develops “treatment plans (education, counseling, loans, voluntary repair agreements, litigation) for dealing with the buildings in poor condition.”

But a closer look at these programs shows that the city has failed to adequately fund many of the initiatives that are supposed to rescue troubled buildings–the very problem DeRienzo feared back in 1995. The 30 NPCP groups play a critical role, but they receive only $40,000 a year to reach out to what are typically hundreds of properties in their neighborhoods, trying to convince landlords to attend classes or apply for loans. “Considering it’s one of the centerpieces of their housing preservation strategy,” observes Adrian DiLollo, the director of ANHD, which represents several NPCP groups, “$40,000 to actively implement a range of housing preservation strategies is woefully inadequate.”

NPCP groups say they not only need more resources, but that they can do little if a property owner refuses to participate. “The owners have to be willing,” says Deb Howard, director of homeowner services for PACC. The groups can also work with tenants, encouraging them to demand repairs, but HPD generally won’t fund that work.

The programs that landlords are directed to are generally well regarded, but, again, they’re underfunded. For example, HPD has both the Participation Loan Program and the Article 8A Loan Program, which offer owners low-interest loans for fixing up buildings. But according to Housing First, a coalition of affordable housing advocates, these programs have only enough money to help about 400 properties a year.

Another HPD program that can help vulnerable properties is the 7A program, through which judges appoint independent administrators to oversee building management. But reduced funding means that as of May 2000, only 170 buildings were in the program. A 2001 update from HPD was not available at press time.

The showpiece of HPD’s anti-abandonment strategy is the third party transfer program, which gives troubled buildings to private landlords or nonprofit organizations with neighborhood experience and clean records, or even transfers them directly to tenant cooperative ownership. With the transfer, the city forgives all debts, grants the new owner tax breaks and provides low-interest loans for rehabilitation.

Housing advocates who normally have few kind words for Giuliani administration policies gush over third party transfer. “HPD seems genuine about involving tenants and giving them a stake in their homes,” says Carol Lamberg, executive director of Settlement Housing Fund, when she found out in March that her agency had won the right to help several buildings transition to tenant ownership. The biggest shortcoming of third party transfer is that it isn’t very big: by the end of the ongoing third phase of the program, only roughly 250 properties will have been transferred to new owners.

Outside of its official efforts, HPD has been willing to help out enterprising landlords willing to take on troubled properties. Peter Hausperg of Eastern Consolidated Properties bought the delinquent mortgages on a pair of crumbling Upper West Side apartment buildings at 212-214 West 109th Street. A 7A administrator was administering the buildings, but HPD was glad to unload the property to a private owner with a good track record, so the agency forgave part of the lien.

The new owner has dramatically improved the once-crumbling properties, spending $25,000 to $30,000 to rehabilitate each unit. But like any businessman, Hausperg did have to recoup his investment. Landlords are allowed to raise rents significantly in regulated buildings if they rehab the apartments, and Hausperg has sought a roughly $625 a month jump in rent.

“There were a whole bunch of two bedrooms renting for $375,” Hausperg says. “I fixed them up and am renting them in the mid $1500s.” Hausperg stressed that he hasn’t evicted any tenants, but some left when their rent skyrocketed. That’s the best case scenario for the new owner, because he can rent vacant units for more than $2,000–and they would no longer be regulated. It was a good investment for Hausperg: “We saw 109th Street, near Columbia, as an up-and-coming area.”

But among all the troubled properties, how many owners, new or old, have actually received city assistance like Haupsberg did? HPD Commissioner Jerilyn Perine told the City Council in May that the Giuliani administration had provided funding so far for the rehabilitation of 20,000 units. That’s equal to about 2,000 buildings, or about 20 percent of those that are excluded. It begs a question: “What happens to multi-family buildings that don’t go into tax lien sales and don’t go into third party transfer?” wonders Legal Services attorney Robinson. “I think they slip through the cracks.”

A more cynical viewpoint is that the city’s exclusion of properties from lien sales isn’t even designed to improve housing. It makes fiscal sense to keep the most troubled residential properties out of the lien sale pool, because the debt on these properties is least likely to be paid back. “They cherry-pick properties to put into the lien pool,” charges Dan Marguiles, president of the Community Housing Improvement Project, a landlords’ organization. “They’re looking for investment-grade liens. For the trust to foreclose on the worst properties, a buyer has to pay 100 percent of taxes. On really troubled property, who’s going to do that?”

_______

Although there are many unanswered questions about tax lien sales, the program seems here to stay. Its hundreds of millions in cash flow are earmarked by everyone from mayoral candidates to housing advocates. The Housing First campaign wants to direct $84.5 million a year from tax lien sales to pay for housing rehabilitation and new housing development, a position backed by Peter Vallone and likely to be embraced by the other candidates in the wake of the loss of the World Trade Center; revenue from the sales of these towers was the main source of affordable housing funding for every Democratic candidate except Mark Green. With the slowing economy already reducing the city’s total tax collections–even before September 11, a $687 million drop was predicted in fiscal year 2002, the first decrease since 1995–the city’s demand for tax lien sales cash will only increase.

An array of powerful interests is also likely to lobby to keep it. There’s JER, which has earned healthy profits since it took over the city’s tax collection. Obtaining precise profit numbers for JER, a private company, is difficult, but observers of the tax lien market say the firm is thriving. There are big investment banks–firms like J.P. Morgan get paid for marketing the bonds. And the Bank of New York, which serves as the trustee, handles all the money for each lien sale. Lastly, major city law firms do the tr